News Release: FOR IMMEDIATE RELEASE

For Additional Information, contact:

|

Senior Vice President & CFO: Nicholas C. Hindman, Sr. Westell Technologies Inc. 630.375.4136 nhind@westell.com

|

Trade/Business Press: Ken Trantowski KGT Communications Group 630.469.8765 kennethg_trantowski@msn.com |

|

|

|

Westell Technologies Reports 3rd Quarter Fiscal 2006 Results

AURORA, IL, JANUARY 18, 2006 - - Westell Technologies, Inc. (NASDAQ: WSTL), a leading provider of broadband access products and conferencing services, announced today the results for the quarter ending December 31, 2005.

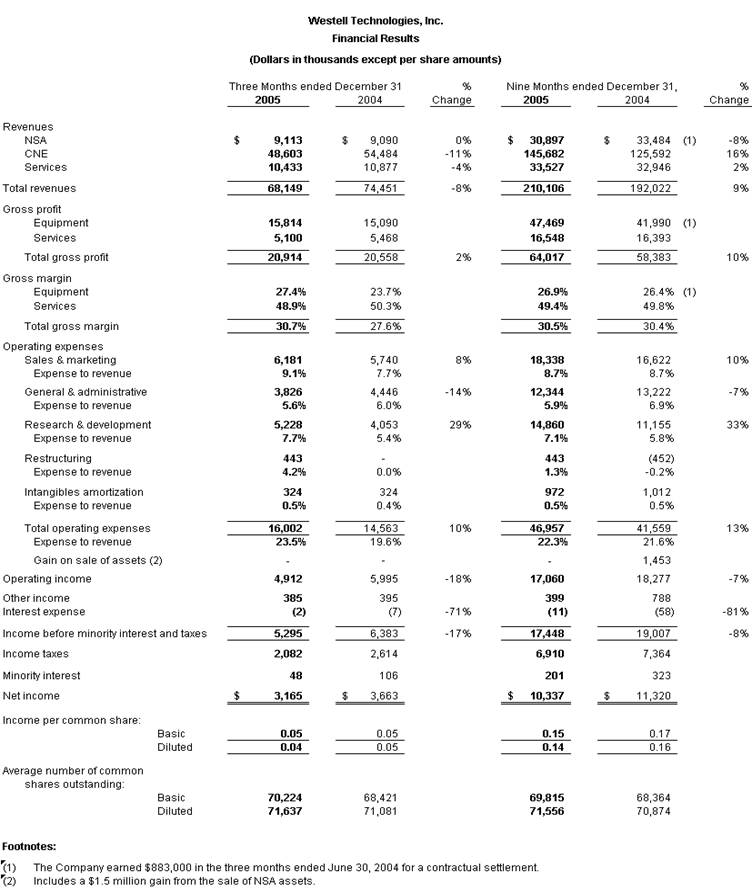

Total revenues for the December 2005 quarter increased 3% to $68.1 million from $66.3 million in the September 2005 quarter. Breaking down revenues by product line for the December quarter compared to the September quarter showed Customer Networking Equipment revenue increased 10% to $48.6 million from $44.0 million; Conferencing Services revenue declined seasonally 7% to $10.4 million from $11.2 million; Network Service Access equipment revenue declined seasonally 18% to $9.1 million from $11.1 million.

Compared to the third quarter of last year, total revenues for the quarter decreased 8% to $68.1 million from $74.5 million. Customer Networking Equipment revenue decreased 11% to $48.6 million from $54.5 million; Conferencing Services revenue declined 4% to $10.4 million from $10.9 million; Network Service Access equipment revenue of $9.1 million was flat compared to $9.1 million in the third quarter of last year. The decline in Customer Networking Equipment revenue was primarily related to a shift in demand due to customer promotional activity away from the Company’s VersaLink gateway

product to the ProLine modem product that carries a lower selling price. Overall unit sales of Customer Networking Equipment increased 42% in the December quarter compared to the comparable quarter of last year.

Westell reported net income for the December 2005 quarter of $3.2 million, or $0.04 per diluted share, which includes income tax expense of $2.1 million, or $0.03 per diluted share. For the September 2005 quarter the Company reported net income of $3.0 million, or $0.04 per diluted share including $2.1 million income tax expense, or $0.03 per diluted share. During the third quarter of last fiscal year, the Company reported net income of $3.7 million, or $0.05 per diluted share including $2.6 million income tax expense, or $0.04 per diluted share.

“We are satisfied with the results for the third quarter of Fiscal 2006, our fifteenth consecutive quarter of profitability,” said Van Cullens, Westell President and CEO. “Our Customer Networking Equipment business improved from the September quarter due to the effective broadband service promotions undertaken by our customers during this period,” he said.

The Company also reported that on December 29, 2005 it acquired 100% of the stock of HyperEdge Corporation. HyperEdge Corporation located in Batavia, Illinois, employs approximately 40 people and conducts a business similar to the Company’s NSA product group.

“The acquisition of HyperEdge was logical given the consolidation that has been going on for some time in this space,” Cullens added. “We believe that the acquisition will benefit both Westell and our customers as we combine the best products, people and processes of the two operations. Feedback from customers has been encouraging and we are already seeing incremental opportunities for both the NSA and even the CNE groups as a result of this deal,” Cullens said.

Outlook

“As we move into 2006, we are focused on adding new customers and expanding our Verizon One™, Westell Media Gateway(, and TriLink ( products into commercial deployment,” Cullens said. “We also will be increasing R&D investment in support of video, VoIP, IMS and home networking oriented solutions that we are targeting,” he added.

Westell provided guidance for the fourth fiscal quarter ending March 31, 2006. The Company expects revenue to be in the range of $72- $75 million. Westell expects EPS to be in a range of $0.03 to $0.04 per diluted share (including a provision for income tax expense in the range of $1.2 to $2.0 million). The revenue guidance reflects $4.8 million of additional revenue expected in the fourth quarter related to the HyperEdge acquisition. EPS guidance reflects increasing R&D expenses as well as one-time costs associated with the HyperEdge acquisition.

Effective Tax Rate for Fiscal Year 2006 Income Statements

Due to the Company’s strong performance in fiscal 2005 and projected future ability to generate taxable income, the Company is required under GAAP to record tax expense in fiscal 2006. The Company’s current effective tax rate approximates 40%. Westell does not expect to incur any significant cash tax payments for the foreseeable future as a result of the anticipated utilization of net operating loss carryforwards to reduce its cash tax liabilities.

Conference Call Information

Westell will host its earnings call on Thursday, January 19 at 9:30 AM Eastern Time for analysts, shareholders, investors and the public.

The live earnings call will be available to the public. Participants can join for the voice portion of the call by following the instructions below. Participants must separately register for the call.

To participate in the voice portion:

|

1. |

All participants must pre-register by dialing 1-888-212-8899, International 1-402-220-3417. |

|

2. |

Leave your name and the company whom you represent. |

|

3. |

To participate in the call on the January 19 please dial ConferencePlus at 1-800-446-1671 no later than 9:15 AM, Eastern Time and ask for the “Westell Technologies Analyst Call”. International participants may dial 847-413-3362. |

The Company’s earnings press release and any related earnings information to be discussed

on the earnings call will be posted on the Investor Relations section of the Company’s web site at http://www.westell.com. Digital Audio Replay of this call will be available one hour following the conclusion of the call by dialing 1-888-843-8996 or 630-652-3044 and entering 13626563#.

About Westell

Westell Technologies, Inc. (NASDAQ: WSTL) headquartered in Aurora, Illinois is an Broadband Access Solutions company that provides leading broadband products, service solutions, and conferencing solutions for carriers, service providers and business enterprises around the world. Westell delivers innovative, open broadband solutions that meet the market’s needs for fast and seamless

broadband connection. Additional information can be obtained by visiting Westell’s Web site at www.westell.com.

About ConferencePlus

Conference Plus, Inc., (ConferencePlus™) a leading global provider of audio, web and videoconferencing services is dedicated to the workplace of the future – now. ConferencePlus is transforming the way work is done through its market-leading multimedia conferencing solutions that combine innovation, proven technology and exceptional customer service. Headquartered in Schaumburg, Illinois with an international headquarters in Dublin, Ireland, ConferencePlus is a subsidiary of Westell Technologies, Inc. (NASDAQ: WSTL). Additional information about ConferencePlus can be obtained by visiting http://www.conferenceplus.com.

“Safe Harbor” statement under the Private Securities Litigation Reform Act 1995:

Certain statements contained herein including, without limitation, statements containing the words “believe,” “on track, “ “anticipate,” “focus,” “should,” “committed” “expect,” “estimate”, “await,” “continue,” “intend,” “may,” “will,” “should,” and similar expressions are forward looking statements that involve risks and uncertainties. These risks include, but are not limited to, product demand and market acceptance risks, need for financing, the economic downturn in the U.S. economy and telecom market, the impact of competitive products or technologies, competitive pricing pressures, product development, excess and obsolete inventory due to new product development, commercialization and technological delays or difficulties (including delays or difficulties in developing, producing, testing and selling new products and technologies), the effect of Westell’s accounting policies, the need for additional capital, the effect of economic conditions and trade, legal social and economic risks (such as import, licensing and trade restrictions) and other risks more fully described in Westell’s Annual Report on Form 10-K for the fiscal year ended March 31, 2005 under the section “Risk Factors”. Westell undertakes no obligation to release publicly the result of any revisions to these forward looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Financial Tables to Follow: