UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

x | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended March 31, 2013

or |

| |

¨ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission file number: 0-27266

WESTELL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 36-3154957 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

750 North Commons Drive, Aurora, Illinois 60504

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (630) 898-2500

|

| | |

Securities registered pursuant to Section 12(b) of the Act: | | Name of each exchange on which registered: |

Class A Common Stock, $.01 par value | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One): |

| | | |

Large Accelerated Filer | ¨ | Accelerated Filer | x |

| | | |

Non-Accelerated Filer | ¨ (Do not check if a smaller reporting company), | Smaller Reporting Company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The estimated aggregate market value of voting and non-voting Class A Common Stock held by non-affiliates (within the meaning of the term under the applicable regulations of the Securities and Exchange Commission) as of September 30, 2012 (based upon an estimate that 62% of the shares are so owned by non-affiliates and upon the average of the high and low prices for the Class A Common Stock on the NASDAQ Global Select Market on that date) was approximately $82 million. Determination of stock ownership by non-affiliates was made solely for the purpose of responding to this requirement and registrant is not bound by this determination for any other purpose.

As of May 14, 2013, 45,073,067 shares of the registrant’s Class A Common Stock were outstanding and 13,937,151 shares of registrant’s Class B Common Stock (which automatically converts on a one-for-one basis into shares of Class A Common Stock upon a transfer of such stock except transfers to certain permitted transferees) were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2013 Annual Stockholders’ Meeting are incorporated by reference into Part III hereof.

WESTELL TECHNOLOGIES, INC.

2013 ANNUAL REPORT ON FORM 10-K CONTENTS

|

| | |

| | Page |

Item | | |

1. | | |

1A. | | |

1B. | | |

2. | | |

3. | | |

4. | | |

| | |

| | |

5. | | |

6. | | |

7. | | |

7A. | | |

8. | | |

9. | | |

9A. | | |

9B. | | |

| | |

| | |

10. | | |

11. | | |

12. | | |

13. | | |

14. | | |

| | |

| | |

15. | | |

| | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements contained herein that are not historical facts or that contain the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “may,” “will,” “plan,” “should,” or derivatives thereof and other words of similar meaning are forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed in or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, product demand and market acceptance risks, need for financing and capital, economic weakness in the United States (“U.S.”) economy and telecommunications market, the effect of international economic conditions and trade, legal, social and economic risks (such as import, licensing and trade restrictions), the impact of competitive products or technologies, competitive pricing pressures, customer product selection decisions, product cost increases, component supply shortages, new product development, excess and obsolete inventory, commercialization and technological delays or difficulties (including delays or difficulties in developing, producing, testing and selling new products and technologies), the ability to successfully consolidate and rationalize operations, the ability to successfully identify, acquire and integrate acquisitions, effects of the Company’s accounting policies, retention of key personnel and other risks more fully described in this Form 10-K for the fiscal year ended March 31, 2013, under Item 1A—Risk Factors. The Company undertakes no obligation to publicly update these forward-looking statements to reflect current events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or otherwise.

Trademarks

The following terms used in this filing are our trademarks: AIDIRECTOR®, AIREMOTE®, AISWITCH®, APPLIED INNOVATION®, WESTELL BOXER®, CellPak®, D-SERV®, eSmartAccess™, Homecloud™, Kentrox®, Optima™, OS Plant Systems®, WESTELL SHADE®, WESTELL TECHNOLOGIES™, VirtualEdge and Design® and Westell®. All other trademarks appearing in this filing are the property of their holders.

PART I

Westell Technologies, Inc., (the “Company”) was incorporated in Delaware in 1980 and is headquartered at 750 North Commons Drive, Aurora, Illinois 60504. In fiscal year 2013, the Company was comprised of two operating segments, Westell and Customer Networking Solutions (“CNS”). Segment financial information for fiscal years 2013, 2012 and 2011 is set forth in the footnotes to the March 31, 2013 consolidated financial statements.

Acquisition of Kentrox

On April 1, 2013, the Company's wholly-owned subsidiary, Westell, Inc. acquired 100% of the Kentrox, Inc. ("Kentrox") stock for $30.0 million cash, subject to an adjustment for working capital and escrow provisions. Kentrox is a worldwide leader in intelligent site management solutions, providing comprehensive monitoring, management and control of any site. The machine-to-machine communications Kentrox provides enable service providers, tower operators, and other network operators to reduce operating costs while improving network performance. Kentrox provides solutions to customers in North and South America, Australia, Africa, and Europe. The assets and liabilities acquired and the results of operations relating to Kentrox will be included in the Company's Consolidated Financial Statements from the date of acquisition.

Acquisition of ANTONE Wireless

On May 15, 2012, Westell, Inc. acquired certain assets and liabilities of ANTONE Wireless Corporation, including rights to ANTONE products, for $2.5 million cash, subject to an adjustment for working capital, plus contingent cash consideration of up to $3.5 million. The contingent consideration is based upon profitability of the acquired products for post-closing periods through June 30, 2016. The acquisition included inventories, property and equipment, contract rights, intangible assets, and certain specified operating liabilities that existed at the closing date. The Company also hired most of ANTONE’s employees. ANTONE products include a line of high-performance Tower-Mounted Amplifiers, Multi-Carrier Power Amplifier Boosters, and cell-site antenna-sharing products.

Sale of ConferencePlus

On December 31, 2011, the Company sold Conference Plus, Inc. (“ConferencePlus”), its conferencing segment, to Arkadin S.A.S. and Arkadin Inc. ConferencePlus results have been classified as discontinued operations on the Consolidated Statements of Operations for all periods presented.

Westell Segment

In the Westell segment, the Company designs, distributes, markets and services a broad range of carrier-class products. The Company’s Westell product family consists of indoor and outdoor cabinets, enclosures and mountings; power distribution products; network interface devices (“NIDs”) for TDM/SONET networks and service demarcation; span powering equipment; remote site monitoring devices; copper/fiber connectivity panels; managed Ethernet switches for utility and industrial networks; Ethernet extension devices for providing native Ethernet service handoff in carrier applications; wireless signal conditioning and monitoring products for cellular networks; tower-mounted amplifiers; cell site antenna-sharing products for cell site optimization; and custom systems integration (“CSI”) services. Legacy products are sold primarily into wireline markets, but the Company also is actively moving to develop revenues from wireless telecommunications products and from industrial and utility companies. In the quarter ended September 30, 2012, the Company completed the relocation of the majority of the power distribution and remote site monitoring products which were manufactured at the Company’s Noran Tel subsidiary located in Regina, Saskatchewan, Canada, to its location in Aurora, Illinois. The remaining operations in Canada are focused on power distribution product development and on sales of Westell products in Canada.

The following table sets forth a list of the Company's principal Westell segment products and their applications:

Westell Segment Products Table

|

| | |

Product Description | | Applications |

Cell Site Optimization: Consists of Tower Mounted Amplifiers, small outdoor-hardened amplifiers mounted next to the antennas on cell towers; and associated ancillary products for powering amplifiers and sharing antenna feeds. | | Used by wireless service providers at cell sites to improve the receive and transmit signal strengths and cell site performance, thereby improving coverage area, data throughput and the overall experience of wireless users, and reducing dropped call rates, dropped packets, and dead zones. |

| |

DAS Interface Panels: Interconnects a wireless Base Transceiver System (BTS) to a Distributed Antenna System (DAS) by providing field-adjustable attenuation and monitoring of the Radio Frequency (RF) levels. | | Used by wireless service providers and neutral-party DAS hosts to fine tune the RF signal levels for maximum performance of a given DAS installation and configuration. Works in both indoor and outdoor DAS locations. |

| |

Ethernet Solutions: Consists of eSmartES Managed Ethernet Switches, industrial-hardened, multiport, remotely-managed Ethernet switches with a variety of port count and connectivity options (both fiber and copper), including models with advanced powering and site telemetry features; and eSmartJack Ethernet NIDs, hardened, remotely-managed Ethernet Network Interface Devices (NIDs) to monitor the performance of Ethernet services and provide a point of demarcation between carrier and end user. | | Used by service providers, utilities and industrial users to create and interface to public or private Ethernet networks in both indoor and harsh outdoor environments. Also used by service providers to interface to Metro Ethernet networks for the backhaul of cellular traffic from cell sites, and the delivery of business-class Ethernet services to end users. Provides management features to show visibility into the performance of the network and the site environment. |

| |

SONET/TDM Solutions: Network Interface Units with Performance Monitoring features for DS3/T3 and DS1/T1 circuits; line repeaters for T1 circuits; and span powering equipment, to inject power onto DS1 spans for powering remote equipment. | | Facilitates the maintenance, monitoring, extension, and demarcation of DS3/T3 and DS1/T1 facilities. Can be deployed in central offices for a DS3 or DS1 hand-off to alternate carriers, in mid-span locations in the outside plant, and also in customer premises locations to provide a point of demarcation between the telecom service provider's equipment and the customer’s equipment. |

| |

Power Distribution: Fuse panels and breaker panels for installation in equipment racks to connect up to bulk power circuits and distribute power to other equipment via individual power feeds with fuses or breakers. | | Standard 19” or 23” rack mounting for service providers central offices, remote terminals and enclosures to provide secondary DC power distribution to operate equipment. Safely protects operating equipment in the event of fault current. |

| | |

Remote Site Monitoring: Rack-mounted devices with internal sensors and connections for external sensors to provide visibility into remote site environmental conditions such as temperature, battery voltage, and equipment status and alarms. Status information and alarms are communicated back to a centralized management system typically located at a network operations center. | | Applications include service provider’s central offices, remote terminals, and enclosures to provide environmental information such as temperature, air flow, humidity and smoke, battery condition, and equipment operating status. |

(Continued from prior page)

Westell Segment Products Table

|

| | |

Product Description | | Applications |

Cabinets, Enclosures and Mountings: Includes outdoor cabinets in a variety of sizes and configurations for sheltering equipment and maintaining a proper operating temperature in harsh outdoor environments; enclosures for protecting equipment in both outdoor and indoor environments; and pre-wired mountings to accommodate plug-in cards from Westell and other manufacturers for a variety of telecom technologies, including Ethernet NIDs, T1 NIUs and HDSL remote terminal cards. | | Outdoor cabinets and enclosures are used by service providers, utilities and industrial users for locating sensitive equipment in exposed outdoor environments. Indoor enclosures house equipment and protect it from unauthorized access. Mountings are deployed by service providers to accommodate line cards which terminate their Ethernet, T1 and HDSL circuits as a point of demarcation at business enterprise customers and at cell sites for cellular backhaul applications. |

| |

Copper/Fiber Connectivity: A flexible portfolio of standard 19” or 23” relay rack mount panels and wall mount enclosures designed with a “mix and match” architecture for Ethernet, fiber or coax cable. These products facilitate easy and simple splicing of optical fiber cables, and/or termination of copper-based Ethernet, and coax handoffs. | | Provides a physical demarcation for Ethernet, DS1/T1, DS3/T3, optical fiber and coax based services at the customer premises. |

| |

Customized Systems Integration Services: A one-stop shop for complete turnkey solutions of customer-specified equipment installed in a Westell cabinet or enclosure. | | CSI service is ideal for customers benefiting from integrated solutions for backhaul, smart grid and other custom applications. CSI reduces time-to-market and the costs of technicians for field installations, and eliminates the need to design, assemble and test on the job site. |

CNS Segment

On April 15, 2011, the Company sold certain assets and transferred certain liabilities of the CNS segment to NETGEAR, Inc. The Company retained a major CNS customer relationship and contract. The Company completed the remaining contractually required product shipments under the retained contract in December 2011. During the first three quarters of fiscal year 2013, the Company continued to provide warranty services under its contractual obligations and to sell ancillary products and software on a project basis to the retained customer.

The Company also retained within its CNS division the Homecloud product. The Homecloud product provides a suite of services into the home for a variety of applications. These applications include: automated backup; file archival and versioning; file sharing and syncing between personal computers and mobile devices; media streaming; network attached file storage; automated syncing of information to public cloud services; and remote access to information. The Company is actively marketing the Homecloud technology for sale and expects limited CNS expense in fiscal year 2014.

Kentrox Summary

Effective as of April 1, 2013 with the acquisition of Kentrox, the Company designs, distributes, markets and services intelligent site management solutions, which provide comprehensive monitoring, management and control of a broad range of devices. The machine-to-machine (M2M) communications Kentrox provides enable service providers, tower operators, and other network operators to reduce operating costs while improving network performance. The Company provides a suite of Remote monitoring and control devices, which when combined with its Optima management system provide a comprehensive, bi-directional solution. The Kentrox solution addresses customer needs such as power management (generator management, battery, fuel, and rectifier monitoring, tenant power metering, etc.), environmental management (HVAC monitoring, energy monitoring and control, aircraft warning light management, and environmental monitoring), security management (access management, asset tampering, and surveillance), and communications management (microwave and distributed antenna systems management). Customers include major wireless and fixed-line telecommunications carriers, tower providers, cable and broadband network providers, utility companies, and enterprises. Kentrox provides solutions to customers in North and South America, Australia, Africa, and Europe.

Kentrox Products and Services Descriptions

Remote Products: Includes monitoring and control devices that provide IP management to remote sites and equipment. The Remote suite of products connects to each element via a wide variety of interface options. Remote performs protocol mediation and interface conversion, collects alarms and monitoring data, and supports bi-directional management control with the Optima management system via Ethernet, T1/E1, or wireless communication options.

Optima Management System: Provides network operators a complete, 360 degree view and control of network infrastructure sites. The management portal provides preventative maintenance tools to help identify issues before they occur. It also provides performance reporting to enable operators to view trending and availability of their networks. Key features include: ability to remotely collect, monitor, trend and report on-site performance; real time dashboard and map views of network and physical elements; remote access from anywhere for remote configuration, backup, and restore or to check the health of the network; and element management for status updates of network elements.

Support and Services: Includes a range of support, maintenance, deployment and training services tailored to meet specific customer needs. The Company's deployment services help implement Kentrox solutions into a network, including site surveys, installation, provisioning, and project management. The Company's training services provide technical training on its Remote products and Optima Management System. The Company's support and maintenance options provide a range of post-deployment support from access to software updates, to next-day on-site technical support.

Research and Development Capabilities and Engineering Base

The Company believes that its future success depends, in part, on its ability to maintain the technological capabilities of its products through enhancements of its existing offerings and to develop new products that meet customer needs. Thus, the Company expects to continue to devote substantial resources to product development.

In fiscal years 2013, 2012 and 2011, the Westell segment incurred approximately $5.7 million, $5.1 million, and $3.8 million and the CNS segment incurred approximately $1.6 million, $2.6 million, and $7.9 million, respectively, of expense for research and development (“R&D”) activities.

The Company's R&D personnel are organized into product development teams. Each product development team is generally responsible for sustaining technical support of existing products, conceiving new products in cooperation with other groups within the Company and adapting standard products or technologies to meet new customer needs. Additionally, in an effort to remain a highly valued, superior quality, long-term supplier, each product development team is charged with reducing product costs for each succeeding generation of products without compromising functionality or serviceability. The product development teams leverage the Company’s relationships with its manufacturing partners and suppliers to achieve these cost reduction objectives.

The Company believes that the key to its R&D strategy is choosing an initial architecture for each product that balances innovation and time-to-market factors while enabling engineering innovations to result in future performance enhancements and cost reductions. The Company’s strategy is further enhanced by ensuring products are designed in conjunction with input from customers, procurement, and outsource manufacturing partners. The Company believes it has a quality record that is grounded in a solid interface and transference of knowledge among design and manufacturing teams.

The Company’s quality systems, including product development processes, are registered to ISO9001:2008 International Quality System Standard and TL9000, which is the Telecommunication Industry's sector-specific version of the ISO9001:2008. The Company believes product quality and reliability are critical and distinguishing factors in a customer’s selection process.

The Company expenses software development costs until its products reach technological feasibility, as defined by software accounting rules.

Pursuant to the Company’s strategic plans and in response to customer and market demands, the Company continues to develop additional models, variants and extensions of the products listed in the above Westell Segment Products Table.

The Company’s products are subject to industry-wide standardization organizations which include Telcordia, the Internet Engineering Task Force, the Metro Ethernet Forum, the American National Standards Institute (“ANSI”) in the U.S. and the International Telecommunications Union (“ITU”).

Customers

The Company's principal customers are providers of telecommunications services and infrastructure (“telecom providers”). These include major wireline and wireless service providers, internet service providers, multiple systems operators ("MSOs") and other telecommunications carriers. The Company historically has served customers predominantly in North America, however, with the recent Kentrox acquisition the Company expects to expand solutions to customers in South America, Australia, Africa, and Europe. The Company also sells products to other entities, including utility and industrial companies, systems integrators and distributors.

Marketing, Sales and Distribution

The Company sells its products through its domestic field sales organization and selected distributors and markets its products to service providers within the U.S. and Canada.

Major service providers require vendor product approval before use in their networks. Evaluation can take as little as a few months for products that vary slightly from existing products and often longer for products based on new technologies and/or new service offerings. Accordingly, the Company is continually submitting successive generations of its current products, as well as new products, to its customers for approval.

The Company provides customer support, technical consulting, research assistance and training to some of its customers with respect to the installation, operation and maintenance of its products.

The Company’s contracts with its major customers are primarily pricing and product specification agreements that detail the commercial terms and conditions for sales. These agreements are requirements-based and typically do not obligate the customer to a specific volume of purchases over time. The agreements may require the Company to accept returns of products within certain time limits, or indemnify such customers against certain liabilities arising out of the use of the Company's products. If these claims or returns are significant, there could be a material adverse effect on the Company's business and results of operations.

Most of the Company’s products carry a limited warranty ranging up to seven years for Westell segment products, which generally covers defects in materials or workmanship and failure to meet published specifications, but excludes damages caused by improper use. In the event there are material deficiencies or defects in the design or manufacture of the Company’s products, the affected products could be subject to recall.

Manufacturing and Procurement

The Company outsources the majority of its manufacturing to both domestic and offshore suppliers. Some Power, Cell Site Optimization, DAS, Ethernet, CSI and remote monitoring products are currently produced at the Company’s headquarters in Aurora, IL. Some Kentrox products are produced in Dublin, OH. Reliance on third-party domestic and offshore subcontractors involves risks. Standard commercial components available from multiple suppliers are procured by the suppliers. In some cases, there are also single-sourced components and technology needed to produce products. The Company has direct relationships and purchase contracts with suppliers for these items and may maintain inventory for these items at the subcontractors’ locations. Critical components, technology shortages or business interruption at our contract manufacturers could cause production delays that may result in expediting costs or lost business.

A substantial portion of the Company's shipments in any fiscal period can relate to orders received in that period. Further, a significant percentage of orders may require delivery within 48 hours. To meet this demand, the Company maintains inventory at its facilities and customers’ sites. Because of the rapid technological changes to our products, the Company faces a recurring risk that the inventory it holds may become obsolete.

Competition

The markets for the Company’s products are intensely competitive and the Company has no reason to believe that this competitive environment will ease in the future. The Company’s primary competitors vary by market. Some of the Company’s principal competitors in the Westell segment include ADTRAN, Inc., Charles Industries, Ciena, Emerson, Purcell, Ruggedcom, TE Connectivity and Telect. Some of the Company's principal competitors in the Kentrox segment include Inala, Quest Controls, Asentria, Invendis and DPS Telecom.

The Westell segment sells demarcation solutions including cabinets, enclosures, T1 network interface units and T1 network protection devices to the cellular backhaul market. The Company believes that as the market transitions from T1 to Ethernet, and as alternative solutions are deployed for cellular backhaul and enterprise connectivity, including Ethernet, fiber and microwave, the demand for the Company’s traditional Westell T1-type transmission products will decline. (Also, see Risk Factors in Item 1A of this report.)

Backlog

Product shipments are generally made pursuant to standard purchase orders, which are officially acknowledged according to standard terms and conditions. Seasonality may cause revenue to differ from quarter to quarter. The Westell segment sells equipment that is installed outdoors and the ordering of such equipment declines during and in advance of the colder months. Budget cycles for our customers may also contribute to revenue variability in those same periods. Purchase orders are generally received less than a month prior to shipment.

As of May 14, 2013, and May 14, 2012, the Westell segment had $2.0 million and $2.8 million of backlog, respectively. The recently acquired Kentrox segment had $10.8 million of backlog as of May 14, 2013.

International Revenue

Revenues from continuing operations from international customers represented approximately $2.4 million, $2.4 million and $2.5 million of the Company’s revenues in fiscal years 2013, 2012, and 2011, respectively, which represents approximately 6.0%, 3.4% and 1.7% of the Company's total revenues in such years.

Major Customers

The Company depends, and may continue to depend, on the telecom service providers and other independent local exchange carriers for the majority of its revenues. Sales to the Company’s largest customers, Verizon, Telamon, and Time Warner Cable accounted for 19.7%, 12.0%, and 10.1%, respectively, of the Company's total revenues in fiscal year 2013.

Proprietary Rights and Intellectual Property

The Company’s success and future revenue growth will depend, in part, on its ability to protect trade secrets, obtain or license patents and operate without infringing on the rights of others. The Company relies on a combination of technical leadership, copyrights, trademarks, trade secrets and other intellectual property, nondisclosure agreements and other protective measures to protect its proprietary know-how. The Company regards some of its technology as proprietary. The expiration of any of the patents held by the Company would not have a material impact on the Company. From time to time, the Company expects to seek additional patents related to its research and development activities.

Employees

As of May 1, 2013, the Company had 174 full-time employees. The following table reflects headcount by segment and functional area. No employees remain in the CNS segment.

|

| | | | | | | | | | | |

| Westell | | Kentrox | | Corporate | | Total |

Operations | 21 |

| | 22 |

| | — |

| | 43 |

|

Sales and marketing | 32 |

| | 16 |

| | — |

| | 48 |

|

Research and development | 34 |

| | 18 |

| | — |

| | 52 |

|

General and administrative | 1 |

| | 8 |

| | 22 |

| | 31 |

|

Total employees | 88 |

| | 64 |

| | 22 |

| | 174 |

|

Available Information

The SEC maintains an internet site, www.sec.gov, through which you may access the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy and other information statements, as well as amendments to these reports. In addition, the Company makes these reports available free of charge on the Company’s internet website, www.westell.com. The Company maintains a corporate governance page on the Company’s website. This page includes, among other items, the Code of Business Conduct, the Audit Committee Charter, the Compensation Committee Charter and the Corporate Governance and Nominating Committee Charter. The corporate governance information can be found at www.westell.com under Investors.

You should carefully consider the risks described below in addition to the other information contained and incorporated by reference in this Form 10-K. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us, or those risks we currently view to be immaterial, may also materially and adversely affect our business, operating results or financial condition. If any of these risks materialize, our business, operating results or financial condition could be materially and adversely affected.

Risks Related to Our Business

General economic conditions may affect our results.

The global economy continues to undergo a period of volatility, which has affected the demand for our equipment and services. A further economic decline could have a material adverse effect on our results of operations and financial condition. The Company may experience a decrease in purchases or usage of our products and services if economic conditions lead to lower utilization of telecommunications services. Customers may stop or decrease purchasing due to efforts to reduce inventory and conserve cash. The Company may also experience business disruptions due to an inability to obtain equipment, parts and supplies from suppliers if fragile supply businesses fail.

We have incurred losses in the past and may incur losses in the future.

We have incurred losses in fiscal years ended March 31, 2013, 2009 and 2008 and historically in fiscal years though 2002. The Company had an accumulated deficit of $242.9 million as of March 31, 2013.

We also expect to continue to evaluate new product and growth opportunities. As a result, we will continue to invest in research and development and sales and marketing, which could adversely affect our short-term operating results. We cannot provide any certainty that we will be profitable in the future.

We depend on a limited number of customers who are able to exert a high degree of influence over us and loss of a major customer could adversely impact our business.

We have and may continue to depend on U.S. telecommunication service providers for the majority of our revenues. The telecommunications companies and our other customers are significantly larger than we are and are able to exert a high degree of influence over us. These customers may often be permitted to reschedule orders without penalty. Even if demand for our products is high, many telecommunication service providers have sufficient bargaining power to demand low prices and other terms and conditions that may materially adversely affect our business and operating results.

Overall sales and product mix sold to our large customers have fluctuated in the past and could vary in the future resulting in significant fluctuations in quarterly operating results which may adversely impact our stock price.

We have completed acquisitions and may engage in future acquisitions that could impact our financial results or stock price.

Our growth strategy includes acquisitions. We recently completed two acquisitions and expect to continue to review potential acquisitions, and we may acquire or make investments in businesses, products or technologies in the future. Any existing or substantial future acquisitions or investments would present a number of risks that could harm our business including:

| |

• | business integration issues; |

| |

• | disruption to our ongoing or our acquired business; |

| |

• | difficulty realizing the intended benefits of the transaction; and |

| |

• | impairment of assets related to acquired goodwill and intangibles. |

Future acquisitions or investments could also result in use of significant cash balances, potential dilutive issuances of equity securities or incurrence of debt, contingent liabilities or amortization expenses related to goodwill and other intangible assets, any of which could adversely affect our financial condition and results of operations.

We have long-term customer pricing contracts with a limited amount of coverage by way of long-term contracts or arrangements with suppliers, which could adversely affect our ability, with certainty or economically, to purchase components and technologies used in our products.

Although we have long-term customer pricing contracts, we have few long-term contracts or arrangements with our suppliers. We may not be able to obtain products or components at competitive prices, in sufficient quantities or under other commercially reasonable terms. We may be unable to pass any significant increase in product costs on to our customers, which could have an adverse impact on our financial results.

Our lack of backlog may affect our ability to adjust for unexpected changes in customer demand.

Customers often place orders for product within the month of their requested delivery date. We therefore typically do not have a material backlog (or known quantity) of unfilled orders, and our revenues in any quarter are substantially dependent on orders booked or orders becoming non-cancellable in that quarter. Our expense levels and inventory commitments are based on anticipated customer demand and are relatively fixed in the short term. If we enter into a high-volume or long-term supply arrangement and subsequently decide that we cannot use the products or services provided for in the supply arrangement then

our business would also be harmed. We enter into short-term contracts with our suppliers in the form of purchase orders. These purchase orders are issued to vendors based on forecasted customer demand. Therefore, we may be unable to cancel purchase orders with our suppliers or adjust spending in a timely manner to compensate for any unexpected shortfall of orders. Accordingly, any significant shortfall of demand in relation to our expectations or any material delay of customer orders could have an adverse impact on our business, operating and financial results.

Conversely, if we order too little product to meet customer demand, we may have insufficient inventory which could result in unplanned expediting costs or lost revenue opportunities, either of which could have an adverse impact on our financial results.

We may experience delays in the development and deployment of new products.

Many of our past sales have resulted from our ability to anticipate changes in technology, industry standards and service provider service offerings, and to develop and introduce new and enhanced products and services. Our continued ability to adapt to such changes will be a significant factor in maintaining or improving our competitive position and our prospects for growth.

There can be no assurance that we will successfully introduce new products on a timely basis or achieve sales of new products in the future. In addition, there can be no assurance that we will have the financial and product design resources necessary to continue to successfully develop new products or to otherwise successfully respond to changing technology standards and service provider service offerings. If we fail to deploy new products on a timely basis, then our product sales will decrease and our competitive position and financial condition would be materially and adversely affected.

Our customers have lengthy purchase cycles and unpredictable purchasing practices that affect our ability to sell our products.

Prior to selling products to service providers, we must undergo lengthy approval and purchase processes. Evaluation can take as little as a few months for products that vary slightly from existing products or up to a year or more for products based on new technologies or utilized for new service offerings. Customers may also choose not to utilize our offerings. Accordingly, we are continually submitting successive generations of our current products as well as new products to our customers for approval.

The requirement that service providers obtain FCC or state regulatory approval for most new telecommunications and broadband services prior to their implementation has in the past delayed the approval process. Such delays in the future could have a material adverse affect on our business and operating results. While we have been successful in the past in obtaining product approvals from our customers, there is no guarantee that such approvals or that ensuing sales of such products will continue to occur.

Our business is subject to the risks of international operations.

We are dependent on our independent offshore manufacturing partners in Asia to manufacture, assemble and test our products. Although there typically is no unique capability with these suppliers, any failure or business disruption by these suppliers to meet delivery commitments would cause us to delay shipments and potentially lose revenue and/or incur contractual penalties. The reliance on third-party subcontractors for assembly of our products involves several risks, including the unavailability of, or interruptions in access to, certain process technologies and reduced control over product quality, delivery schedules, transportation, manufacturing yields, and costs. These risks may be exacerbated by economic or political uncertainties, terrorist actions, or by natural pandemics or other disasters in countries in which our subcontractors or their subcontractors are located. Contracts with our outsource manufacturing partners are generally expressed in U.S. dollars, but volatility in foreign currency rates could increase our costs.

As a result of the April 1, 2013, Kentrox acquisition, we expect to derive an increased portion of our revenue from international operations. As a result, our financial condition and operating results could be significantly affected by risks associated with international activities, such as tax laws, currency translation risks, and complex regulatory requirements as conditions of doing business. Requirements for international expansion may increase our operating expenses or working capital needs.

Due to the rapid pace of technological change and volatile customer demand, our products may become obsolete and could cause us to incur charges for excess and obsolete inventory which would materially harm our business.

The telecommunications industry is subject to rapid technological change and volatile customer demands, which affected our past results and could result in inventory obsolescence or excess inventory. We have in the past and may in the future devote disproportionate resources to a product that we ultimately may not sell or have to sell for a loss. If we incur substantial inventory impairments that we are not able to recover because of changing market conditions, or if we commit resources that

do not result in profitable sales, there could be a material adverse effect on our business, financial condition and results of operations.

Our products and services face intense competition. Our failure to compete successfully could materially affect our profitability.

Because we are smaller than many of our competitors, we may lack the financial, marketing, technical and other resources needed to increase or maintain our market share. Many of our competitors are larger than we are and may be able to offer a wider array of products and services required for a service provider’s business than we do.

Competitors may succeed in establishing more technologically advanced products and services, or products with more favorable pricing or may otherwise gain an advantage over our products which would result in lost business that would adversely impact our profitability.

Because of intense competition, we may price our products and services at low margins in order to win or maintain business. Low margins from our sales of products and services could materially and adversely affect our profitability and ability to achieve our business goals.

We are dependent on third-party technology, the loss of which would harm our business.

We rely on third parties for technology in our products. Consequently, the Company must rely upon third parties to develop and to introduce technologies which enhance the Company's current products and enable the Company, in turn, to develop its own products on a timely and cost-effective basis to meet changing customer needs and technological trends in the telecommunications industry. Were the Company to lose the ability to obtain needed technology from a supplier, or were that technology no longer available to the Company under reasonable terms and conditions, the Company’s business and results of operations could be materially and adversely affected.

Potential product recalls, service failures and warranty expenses could adversely affect our profitability.

Our products are required to meet rigorous standards imposed by our customers, and we warrant the performance of these products and services. In addition, our supply contracts with our major customers typically require us to accept returns of products within certain time frames and indemnify such customers against certain liabilities arising out of the use of our products or services. Complex products such as those offered by us may contain undetected defects or failures when first introduced or as new versions are released. Despite our testing of products and our comprehensive quality control program, there is no guarantee that our products will not suffer from defects or other deficiencies. If product defects, recalls, warranty returns, failures, indemnification or liquidated-damage claims exceed our anticipated costs for these items, our business could be harmed. Such claims and the associated negative publicity could result in the loss of or delay in market acceptance of our products and services, and could affect our product sales, our customer relationships, and our profitability.

We are dependent on sole or limited source suppliers, the loss of which would harm our business.

Components used in our products may be currently available from only one source or a limited number of suppliers. Our inabilities to obtain sufficient key components or to develop alternative sources for key components as required, could result in delays or reductions in product deliveries, and consequently severely harm our customer relationships and our business. Furthermore, additional sole-source components may be incorporated into our future products, thereby increasing our supplier risks. If any of our sole-source suppliers delay or halt production of any of their components, or fail to supply their components on commercially reasonable terms, then our business and operating results would be harmed.

In the event that these suppliers discontinue the manufacture of materials used in our products, we would be forced to incur the time and expense of finding a new supplier, if available, or to modify our products in such a way that such materials were not necessary, which could result in increased manufacturing costs.

New regulations related to conflict minerals could adversely impact our business.

The Dodd-Frank Wall Street Reform and Consumer Protection Act contains provisions concerning the supply of “conflict” minerals mined from the Democratic Republic of Congo and adjoining countries (“DRC”). As a result, the SEC established annual disclosure and reporting requirements for those companies who may use conflict minerals sourced from the DRC in their products. There will be costs associated with complying with these disclosure requirements, including diligence costs to determine the sources of conflict minerals used in our products. These new requirements also could limit the pool of suppliers who can provide conflict-free minerals and, as a result, we cannot ensure that we will be able to obtain these minerals at competitive prices. In addition, we may face challenges with our customers or with our reputation if we determine that certain

of our products contain minerals not determined to be conflict free or if we are unable to sufficiently verify the origins of the minerals used in our products.

We may be subject to litigation that could be costly to defend and could impact our profitability.

Our products use third party and open source intellectual property. The telecommunications industry is characterized by the existence of an increasing number of patents and frequent litigation based on allegations of patent and other intellectual property infringement. From time to time we receive communications from third parties alleging infringement of exclusive patent, copyright and other intellectual property rights to technologies that are important to us. Such litigation, regardless of its outcome, could result in substantial costs and thus adversely impact our profitability. We could face securities litigation or other litigation that could result in the payment of substantial damages or settlement costs in excess of our insurance coverage. Any adverse outcome could harm our business. Even if we were to prevail in any such litigation, we could incur substantial legal costs and management's attention and resources could be diverted from our business which could cause our business to suffer.

We will not be able to successfully compete, develop and sell products and services if we fail to retain key personnel and hire additional key personnel.

Because of our need to continually compete for customer business, our success is dependent on our ability to attract and retain qualified technical, marketing, sales and management personnel. To remain competitive, we must maintain top management talent, employees who are involved in product development and testing and employees who have developed strong customer relationships. Because of the high demand for these types of employees, it may be difficult to retain existing key employees and attract new key employees. In addition, we do not have non-compete contracts with most of our employees. Our inability to attract and retain key employees could harm our ability to successfully sell existing products, develop new products, and implement our business goals.

Industry consolidation and divestiture could make competing more difficult.

Consolidation of companies offering competing products is occurring through acquisitions, joint ventures and licensing arrangements involving our competitors, our customers and our customers’ competitors.

Our customers may acquire, merge or divest territories to other telecommunication service providers. The acquiring companies often use competitor products in their legacy business. We are often required to formally bid to retain existing business or obtain new business in the acquirer’s territory.

We cannot provide any assurances that we will be able to compete successfully in an increasingly consolidated telecommunications industry or retain or win business when existing customers divest portions of their business to others. Any heightened competitive pressures that we may face may have a material adverse effect on our business, prospects, financial condition and results of operations.

Utilization of our deferred tax assets could be limited by an ownership change as defined by Section 382 of the Internal Revenue Code, or by a change in the tax code, or by our ability to generate future taxable income.

We have significant deferred tax assets, primarily in the form of net operating losses, which are generally available to offset future taxable income. If we fail to generate sufficient future taxable income, net operating losses would expire prior to utilization. A valuation allowance was recorded against all deferred tax assets in the fourth quarter of fiscal year 2013. A change in ownership, as defined by Section 382 of the Internal Revenue Code, could reduce the availability of those tax assets. In addition, some tax jurisdictions such as Illinois and California have suspended the use of net operating losses to offset future taxable income for a period of time. Additional federal or state tax code changes could further limit our use of deferred tax assets and harm our business and our investors.

We have and may incur liabilities in connection with the sale of certain assets and discontinued operations.

In connection with our divestitures of ConferencePlus and substantially all of the assets of the CNS business, we have agreed to indemnify parties against specified losses with respect to those transactions and retained responsibility for various legal liabilities that may accrue. The indemnities relate to, among other things, liabilities which may arise with respect to the period during which we operated the divested business, and to certain ongoing contractual relationships and entitlements with respect to which we made commitments in connection with the divestiture. We have incurred and may incur additional expenses defending indemnity and third party claims. These added expenses to resolve the claim or to defend against the third party action could harm our operating results. In addition, such claims may divert management attention from our continuing business. It may also be difficult to determine whether a claim from a third party stemmed from actions taken by us or by another party and we may expend substantial resources trying to determine which party has responsibility for the claim.

Any restructuring activities that we may undertake may not achieve the benefits anticipated and could result in additional unanticipated costs, which could have a material adverse effect on our business, financial condition, cash flows or results of operations.

We regularly evaluate our existing operations and, as a result of such evaluations, may undertake restructuring activities within our business. These restructuring activities may involve higher costs or longer timetables than we anticipate, including costs related to severance and other employee-related matters, litigation risks and expenses, and other costs. These restructuring activities may disrupt sales or operations and may not result in improvements in future financial performance. If we incur unanticipated costs or are unable to realize the benefits related to restructuring activities, the activities could have a material adverse effect on our business, financial condition, cash flows or results of operations.

An impairment of goodwill or other intangible assets could adversely impact our reported financial results.

At least annually, we are required to test our goodwill to determine if impairment has occurred. Events or circumstances could arise that may create a need to record an impairment adjustment related to our goodwill or other intangible assets that could adversely impact our reported financial results. A goodwill impairment charge was recorded in the fourth quarter of fiscal year 2013 that reduced goodwill balances existing at that time to zero.

Our business may be affected by uncertain government regulation, and current or future laws or regulations could restrict the way we operate our business or impose additional costs on our business.

The telecommunications industry, including most of our customers, is subject to regulation from federal and state agencies, including the FCC and various state public utility and service commissions. While most such regulations do not affect us directly, the effects of regulations on our customers may adversely impact our business and operating results. For example, FCC regulatory policies affecting the availability of telecommunication company services and other terms on which telecommunication companies conduct their business may impede our penetration of local access markets, and/or make the markets less financially attractive.

Risks Related to our Common Stock

Our stock price is volatile and could drop unexpectedly.

Like many technology companies, our stock price has demonstrated and may continue to demonstrate volatility as valuations, trading volumes and prices vary significantly. Such volatility may result in a material decline in the market price of our securities, and may have little relationship to our financial results or prospects.

We could be the subject of future investigation by the SEC or other governmental authorities that could adversely affect our financial condition, results of operations and the price of our common stock.

In the event that an investigation by the SEC or other governmental authorities leads to significant legal expense or to action against the Company or its directors and officers, our financial condition, results of operations and the price of our common stock may be adversely impacted.

Our principal stockholders can exercise significant influence that could discourage transactions involving a change of control and may affect your ability to receive a premium for Class A Common Stock that you purchase.

As of May 14, 2013, as trustees of a voting trust dated February 23, 1994, (the “Voting Trust”) containing common stock held for the benefit of the Penny family, Robert C. Penny III and Robert W. Foskett have the exclusive power to vote over 51.4% of the votes entitled to be cast by the holders of our common stock. In addition, members of the Penny family who are beneficiaries under this Voting Trust are parties to a stock transfer restriction agreement which prohibits the beneficiaries from transferring any Class B Common Stock or their beneficial interests in the Voting Trust without first offering such Class B Common Stock to the other Penny family members. Certain Penny family members also own or are beneficiaries of trusts that own shares outside of the Voting Trust. As trustees of the Voting Trust and other trusts, Messrs. Penny and Foskett control 55.4% of the stock vote. Consequently, we are effectively under the control of Messrs. Penny and Foskett, as trustees, who can effectively control the election of all of the directors and determine the outcome of most corporate transactions or other matters submitted to the stockholders for approval. Such control may have the effect of discouraging transactions involving an actual or potential change of control, including transactions in which the holders of Class A Common Stock might otherwise receive a premium for their shares over the then-current market price.

|

| |

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

The Company leases the following real property:

|

| | | | | | |

Location | Purpose | | Square footage | | Termination year |

Aurora, IL | Office, distribution and manufacturing | | 185,000 |

| | 2017 |

Regina, Saskatchewan, Canada | Office, sales and R&D | | 2,500 |

| | 2017 |

Goleta, CA | Office and R&D | | 2,611 |

| | 2013 |

The Aurora facility is used for its corporate headquarters, product distribution, and warranty processing. In November 2012, the company entered into a site license to sublease a portion of the Aurora facility to a third party through May 31, 2013, with a subsequent month-to-month option. Alternative uses are currently being explored for portions of the Aurora facility that exceed the Company’s requirements.

On April 1, 2013, as a result of the Kentrox acquisition, the Company acquired a 16 acre parcel of land in Dublin, Ohio. Additionally, Kentrox leases 13,000 square feet of office and manufacturing space in Dublin, Ohio. This lease terminates December 31, 2013.

The Company is involved in various legal proceedings incidental to the Company’s business and its previously owned operations. In the ordinary course of our business, we are routinely audited and subject to inquiries by governmental and regulatory agencies. Although it is not possible to predict with certainty the outcome of these or other unresolved legal actions or the range of possible loss, management believes that the outcome of such proceedings will not have a material adverse effect on our consolidated operations or financial condition.

|

| |

ITEM 4. | MINE SAFETY DISCLOSURES |

Not Applicable.

PART II

|

| |

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Company’s Class A Common Stock is quoted on the NASDAQ Global Select Market under the symbol “WSTL”. The following table sets forth for the periods indicated the high and low sale prices for the Class A Common Stock as reported on the NASDAQ Global Select Market.

|

| | | | | | | |

| High | | Low |

Fiscal Year 2013 | | | |

First Quarter ended June 30, 2012 | $ | 2.46 |

| | $ | 2.10 |

|

Second Quarter ended September 30, 2012 | 2.40 |

| | 1.93 |

|

Third Quarter ended December 31, 2012 | 2.20 |

| | 1.73 |

|

Fourth Quarter ended March 31, 2013 | 2.17 |

| | 1.75 |

|

Fiscal Year 2012 | | | |

First Quarter ended June 30, 2011 | $ | 3.93 |

| | $ | 3.16 |

|

Second Quarter ended September 30, 2011 | 3.61 |

| | 2.09 |

|

Third Quarter ended December 31, 2011 | 2.52 |

| | 1.94 |

|

Fourth Quarter ended March 31, 2012 | 2.52 |

| | 2.18 |

|

As of May 14, 2013, there were approximately 575 holders of record of the outstanding shares of Class A Common Stock and five holders of record of Class B Common Stock.

During the fiscal year ended March 31, 2013, no equity securities of the Company were sold by the Company that were not registered under the Securities Act of 1933, as amended.

Dividends

The Company has never declared or paid any cash dividends on its common stock and does not anticipate paying any cash dividends in the foreseeable future.

Issuer Purchases of Equity Securities

The following table provides information about the Company’s repurchase activity for its Class A Common Stock during the three months ended March 31, 2013.

|

| | | | | | | | | | | | | |

Period | Total Number of Shares Purchased (a) | | Average Price Paid per Share (b) | | Total Number of Shares Purchased as Part of Publicly Announced Programs (c) | | Maximum Number (or Approximate Dollar Value) that May Yet Be Purchased Under the Programs (c) |

January 1-31, 2013 | 17,650 |

| | $ | 1.9048 |

| | 17,650 |

| | $ | 112,741 |

|

February 1-28, 2013 | — |

| | $ | — |

| | — |

| | $ | 112,741 |

|

March 1-31, 2013 | 9,412 |

| | $ | 1.8300 |

| | — |

| | $ | 112,741 |

|

Total | 27,062 |

| | $ | 1.8886 |

| | 17,650 |

| | $ | 112,741 |

|

| |

(a) | In March 2013, the Company repurchased 9,412 shares from an executive that were surrendered to satisfy the minimum statutory tax withholding obligations on the vesting of restricted stock units. These repurchases were not included in the authorized share repurchase program and had a weighted-average purchase price of $1.83 per share. |

| |

(b) | Average price paid per share includes commissions. |

| |

(c) | In August 2011, the Board of Directors authorized a share repurchase program whereby the Company could repurchase up to an additional aggregate of $20.0 million of its outstanding Class A Common Stock. |

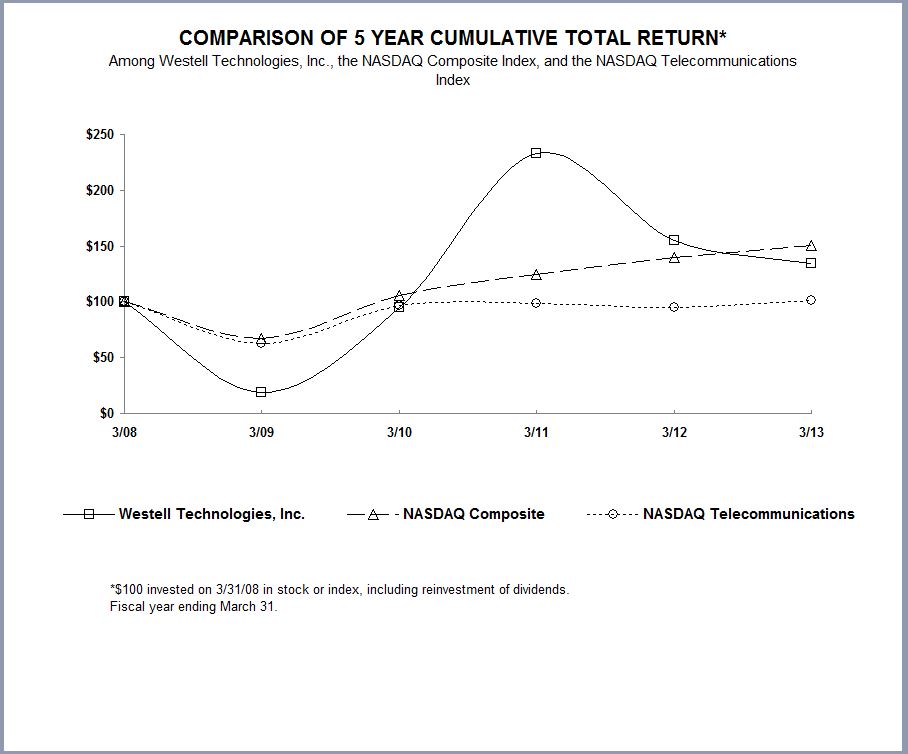

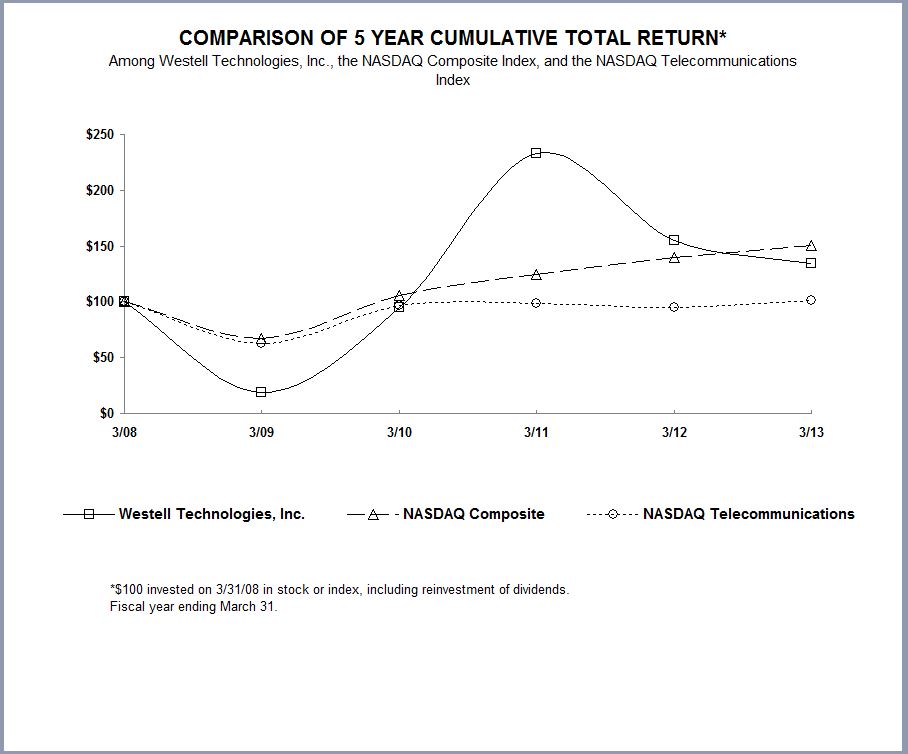

Performance Graph

The following performance graph compares the change in the Company’s cumulative total stockholder return on its Class A Common Stock with the cumulative total return of the NASDAQ Composite Index and the NASDAQ Telecommunications Index for the period commencing March 31, 2008 and ending March 31, 2013. The stock price performance shown in the performance graph may not be indicative of future stock performance price.

|

| | | | | | | | | | | | | | | | | |

| 3/08 | | 3/09 | | 3/10 | | 3/11 | | 3/12 | | 3/13 |

Westell Technologies, Inc. | 100.00 |

| | 18.67 |

| | 94.67 |

| | 233.33 |

| | 155.33 |

| | 134.00 |

|

NASDAQ Composite | 100.00 |

| | 67.15 |

| | 105.94 |

| | 124.71 |

| | 139.71 |

| | 150.83 |

|

NASDAQ Telecommunications | 100.00 |

| | 62.46 |

| | 96.85 |

| | 98.99 |

| | 95.20 |

| | 101.20 |

|

|

| |

ITEM 6. | SELECTED FINANCIAL DATA |

The following selected consolidated financial data as of March 31, 2013, 2012, 2011, 2010 and 2009 and for each of the five fiscal years in the period through fiscal year 2013 have been derived from the Company's Consolidated Financial Statements. The Company sold its ConferencePlus subsidiary in fiscal year 2012 and is reporting the results of ConferencePlus as discontinued operations. The data set forth below is qualified by reference to, and should be read in conjunction with, "Management's Discussion and Analysis of Financial Condition and Results of Operations”, the Consolidated Financial

Statements and the related Notes thereto and other financial information appearing elsewhere in this Annual Report on Form 10-K.

|

| | | | | | | | | | | | | | | | | | | |

(in thousands, except per share data) | Fiscal Year Ended March 31, |

Statement of Operations Data: | 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

Revenue | $ | 40,044 |

| | $ | 69,655 |

| | $ | 147,849 |

| | $ | 139,764 |

| | $ | 140,714 |

|

Cost of goods sold | 25,720 |

| | 46,398 |

| | 106,297 |

| | 102,374 |

| | 109,762 |

|

Gross profit | 14,324 |

| | 23,257 |

| | 41,552 |

| | 37,390 |

| | 30,952 |

|

Operating expenses: | | | | | | | | | |

Sales and marketing | 7,439 |

| | 6,496 |

| | 10,813 |

| | 10,770 |

| | 14,929 |

|

Research and development | 7,326 |

| | 7,727 |

| | 11,774 |

| | 11,363 |

| | 17,633 |

|

General and administrative | 9,910 |

| | 7,615 |

| | 8,623 |

| | 9,020 |

| | 12,151 |

|

Intangible amortization | 892 |

| | 548 |

| | 545 |

| | 529 |

| | 1,820 |

|

Restructuring | 149 |

| | 550 |

| | — |

| | 460 |

| | 591 |

|

Goodwill impairment | 2,884 |

| | — |

| | — |

| | — |

| | 1,381 |

|

Total operating expenses | 28,600 |

| | 22,936 |

| | 31,755 |

| | 32,142 |

| | 48,505 |

|

Operating income (loss) from continuing operations | (14,276 | ) | | 321 |

| | 9,797 |

| | 5,248 |

| | (17,553 | ) |

Gain on CNS asset sale | — |

| | 31,654 |

| | — |

| | — |

| | — |

|

Other income (expense), net | 175 |

| | 331 |

| | 20 |

| | 13 |

| | 791 |

|

Income (loss) from continuing operations before income tax | (14,101 | ) | | 32,306 |

| | 9,817 |

| | 5,261 |

| | (16,762 | ) |

Income tax (expense) benefit | (29,392 | ) | | (12,875 | ) | | 53,304 |

| | 814 |

| | 21 |

|

Net income (loss) from continuing operations | (43,493 | ) | | 19,431 |

| | 63,121 |

| | 6,075 |

| | (16,741 | ) |

Gain on sale of discontinued operations, net of tax expense of $12,359 | — |

| | 20,489 |

| | — |

| | — |

| | — |

|

Income (loss) from discontinued operations, net of tax expense (benefit) of $(813), $1,447, $53, $256 and $98, respectively | (545 | ) | | 2,062 |

| | 4,815 |

| | 4,252 |

| | 147 |

|

Net income (loss) | $ | (44,038 | ) | | $ | 41,982 |

| | $ | 67,936 |

| | $ | 10,327 |

| | $ | (16,594 | ) |

Basic net income (loss) per share: | | | | | | | | | |

Basic net income (loss) from continuing operations | $(0.73) | | $0.29 | | $0.93 | | $0.09 | | $(0.24) |

Basic net income (loss) from discontinued operations | (0.01) | | 0.34 | | 0.07 | | 0.06 | | 0.01 |

Basic net income (loss) per share* | $(0.73) | | $0.63 | | $1.00 | | $0.15 | | $(0.24) |

Average number of basic common shares outstanding | 59,944 |

| | 66,657 |

| | 67,848 |

| | 67,987 |

| | 69,470 |

|

Diluted net income (loss) per share: | | | | | | | | | |

Diluted net income (loss) from continuing operations | $(0.73) | | $0.29 | | $0.91 | | $0.09 | | $(0.24) |

Diluted net income (loss) from discontinued operations | (0.01) | | 0.33 | | 0.07 | | 0.06 | | 0.01 |

Diluted net income (loss) per share* | $(0.73) | | $0.62 | | $0.98 | | $0.15 | | $(0.24) |

Average number of diluted common shares outstanding | 59,944 |

| | 67,979 |

| | 69,477 |

| | 68,573 |

| | 69,470 |

|

Balance Sheet Data (at end of period): | | | | | | | | | |

Cash and cash equivalents | $ | 88,233 |

| | $ | 120,832 |

| | $ | 86,408 |

| | $ | 61,315 |

| | $ | 46,058 |

|

Working capital ** | 12,637 |

| | 12,461 |

| | 29,457 |

| | 17,959 |

| | 19,001 |

|

Total assets | 145,172 |

| | 197,426 |

| | 201,387 |

| | 121,834 |

| | 115,564 |

|

Total stockholders’ equity | $ | 131,077 |

| | $ | 186,364 |

| | $ | 159,281 |

| | $ | 87,731 |

| | $ | 76,448 |

|

*Per share may not sum to totals because of rounding.

**Working capital is defined as current assets less cash and cash equivalents, restricted cash, short-term investments and current liabilities.

See Note 1 for additional information on the recent acquisitions and divestitures.

|

| |

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview

The following discussion should be read together with the Consolidated Financial Statements and the related Notes thereto and other financial information appearing elsewhere in this Form 10-K. All references herein to the term “fiscal year” shall mean a year ended March 31 of the year specified.

The Company commenced operations in 1980 as a provider of telecommunications network transmission products that enable advanced telecommunications services over copper telephone wires. The Company currently has two reportable segments: Westell and Customer Networking Solutions ("CNS"). Until fiscal 1994, the Company derived substantially all of its revenues from its Westell segment products, particularly the sale of Network Interface Unit (“NIU”) products and related products. The Company introduced its first CNS products in fiscal 1993. The Company also provided audio teleconferencing services from fiscal 1989 until Conference Plus, Inc was sold on December 31, 2011. The Company realizes the majority of its revenues from the North American market.

On April 1, 2013, the Company acquired Kentrox, Inc. ("Kentrox") for $30.0 million, subject to an adjustment for working capital. Kentrox is a worldwide leader in intelligent site management solutions. The Company expects to report Kentrox as a separate segment during fiscal year 2014. The acquisition qualifies as a business combination and will be accounted for from the date of acquisition using the acquisition method of accounting.

On May 15, 2012, the Company acquired certain assets and liabilities of ANTONE Wireless Corporation (“ANTONE”), including rights to ANTONE products, for $2.5 million cash, subject to an adjustment for working capital, plus contingent cash consideration of up to an additional $3.5 million. The contingent consideration is based upon profitability of the acquired products for post-closing periods through June 30, 2016, and may be offset by working capital adjustments and indemnification claims. The acquisition included inventories, property and equipment, contract rights, customer relationships, technology, and certain specified operating liabilities that existed at the closing date. The Company hired nine of ANTONE’s employees. ANTONE products include high-performance tower-mounted amplifiers, multi-carrier power amplifier boosters, and cell-site antenna sharing products. The acquisition qualifies as a business combination and has been accounted for using the acquisition method of accounting from the date of acquisition.

On December 31, 2011, the Company sold its wholly owned subsidiary, Conference Plus, Inc. including Conference Plus Global Services, Ltd (“CGPS”), a wholly owned subsidiary of ConferencePlus (collectively, “ConferencePlus”) to Arkadin for $40.3 million in cash (the “ConferencePlus sale”). Of the total purchase price, $4.1 million was placed in escrow at closing for one year as security for certain indemnity obligations of the Company. The Company subsequently agreed to extend the escrow period to June 10, 2013. During the three months ended December 31, 2012, the Company recorded a contingent liability of $1.5 million, pre-tax, relating to impending claims raised by Arkadin under the indemnity provisions of the purchase sales agreement. In the quarter ended March 31, 2013, $1.6 million of the escrow was released. The Company expects the cash held in escrow that is in excess of the obligation covered by the indemnity provisions to be released to the Company during fiscal year 2014.

On April 15, 2011, the Company sold certain assets and transferred certain liabilities of the CNS segment to NETGEAR, Inc. for $36.7 million in cash (the “CNS asset sale”). As part of the CNS asset sale, most of the CNS segment’s customer relationships, contracts and employees were transferred to NETGEAR. The Company retained a major CNS customer relationship and contract. The Company completed the remaining contracted product shipments under this contract in December 2011. During the first three quarters of fiscal year 2013, the Company continued to provide warranty services under its contractual obligations and to sell ancillary products and software on a project basis to the retained customer. The Company expects no CNS activity with that retained customer going forward. The Company also retained the Homecloud product development program. The Homecloud product family aims to provide a new suite of services into the home, with an initial focus on media and information management, sharing and delivery, and with prospective functionality applicable to enhanced security, home control, and network management.

In the Westell segment, the Company designs, distributes, markets and services a broad range of carrier-class products. The Company’s Westell product family consists of indoor and outdoor cabinets, enclosures and mountings; power distribution products; network interface devices (“NIDs”) for TDM/SONET networks and service demarcation; span powering equipment; remote monitoring devices; copper/fiber connectivity panels; managed Ethernet switches for utility and industrial networks; Ethernet extension devices for providing native Ethernet service handoff in carrier applications; wireless signal conditioning and monitoring products for cellular networks; tower-mounted amplifiers; cell site antenna-sharing products for cell site

optimization; and custom systems integration (“CSI”) services. Legacy products are sold primarily into wireline markets, but the Company also is actively moving to develop revenues from wireless telecommunications products. In the quarter ended September 30, 2012, the Company completed the relocation of the production of power distribution and remote monitoring products, which were manufactured at the Company’s Noran Tel subsidiary located in Regina, Saskatchewan, Canada, to its location in Aurora, Illinois. The remaining operations in Regina, Canada, are focused on power distribution product development and on sales of Westell products in Canada. Effective as of April 1, 2013 with the acquisition of Kentrox, the Company designs, distributes, markets and services intelligent site management solutions, which provide comprehensive monitoring, management and control of a broad range of devices. The machine-to-machine (M2M) communications Kentrox provides enable service providers, tower operators, and other network operators to reduce operating costs while improving network performance. The Company provides a suite of Remote monitoring and control devices, which when combined with its Optima management system provide a comprehensive, bi-directional solution. The Kentrox solution addresses customer needs such as power management (generator management, battery, fuel, and rectifier monitoring, tenant power metering, etc.), environmental management (HVAC monitoring, energy monitoring and control, aircraft warning light management, and environmental monitoring), security management (access management, asset tampering, and surveillance), and communications management (microwave and distributed antenna systems management). Customers include major wireless and fixed-line telecommunications carriers, tower providers, cable and broadband network providers, utility companies, and enterprises. Kentrox provides solutions to customers in North and South America, Australia, Africa, and Europe.

The prices for the Company's products vary based upon volume, customer specifications and other criteria, and they are subject to change for a variety of reasons, including cost and competitive factors.

The Company’s customer base for its products is highly concentrated and comprised primarily of major telecommunications service providers, independent domestic local exchange carriers and public telecom administrations located in the U.S. and Canada. Due to the stringent quality specifications of its customers and the regulated environment in which its customers operate, the Company must undergo lengthy approval and procurement processes prior to selling most of its products. Accordingly, the Company must make significant up-front investments in product and market development prior to actual commencement of sales of new products.