UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

|

| |

x | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended March 31, 2015

or |

| |

¨ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission file number: 0-27266

WESTELL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 36-3154957 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

750 North Commons Drive, Aurora, Illinois 60504

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (630) 898-2500

|

| | |

Securities registered pursuant to Section 12(b) of the Act: | | Name of each exchange on which registered: |

Class A Common Stock, $.01 par value | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One): |

| | | |

Large Accelerated Filer | ¨ | Accelerated Filer | x |

| | | |

Non-Accelerated Filer | ¨ (Do not check if a smaller reporting company), | Smaller Reporting Company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The estimated aggregate market value of voting and non-voting Class A Common Stock held by non-affiliates (within the meaning of the term under the applicable regulations of the Securities and Exchange Commission) as of September 30, 2014 (based upon an estimate that 66% of the shares are so owned by non-affiliates and upon the average of the high and low prices for the Class A Common Stock on the NASDAQ Global Select Market on that date) was approximately $79 million. Determination of stock ownership by non-affiliates was made solely for the purpose of responding to this requirement and registrant is not bound by this determination for any other purpose.

As of May 14, 2015, 46,892,935 shares of the registrant’s Class A Common Stock were outstanding and 13,937,151 shares of registrant’s Class B Common Stock (which automatically converts on a one-for-one basis into shares of Class A Common Stock upon a transfer of such stock except transfers to certain permitted transferees) were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2015 Annual Stockholders’ Meeting are incorporated by reference into Part III hereof.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A ("Amendment No. 1") amends the Annual Report on Form 10-K of Westell Technologies, Inc. (the “Company”) for the fiscal year ended March 31, 2015, as originally filed with the Securities and Exchange Commission (the “SEC”) on May 22, 2015 (the “Original Filing”). This Amendment No. 1 amends the Original Filing to correct an error related to a previously unidentified pre-acquisition liability, as more fully described in Note 1 to the Consolidated Financial Statements contained in this Amendment No. 1. For ease of reference, this Amendment No. 1 amends and restates the Original Filing in its entirety. Revisions to the Original Filing have been made to the following sections:

| |

• | Item 6 - Selected Financial Data |

| |

• | Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| |

• | Item 8 - Financial Statements and Supplementary Data |

| |

• | Item 9A - Controls and Proceedures |

| |

• | Exhibit 23.1 - Consent of Ernst & Young LLP |

In addition, the Company’s principal executive officer and principal financial officer have provided new certifications in connection with this Amendment No. 1 (Exhibits 31.1, 31.2, and 32.1).

Management assessed its evaluation of the effectiveness of the Company's internal control over financial reporting as of March 31, 2015 based on the framework established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Management has concluded that the Company's internal control over financial reporting was effective as of March 31, 2015 in spite of the restatement required because the restatement was caused by a previously unidentified pre-acquisition liability. The Company's controls effectively detected this error at the first opportunity following the acquisition for the control to function.

Except as described above, no other amendments have been made to the Original Filing. This Amendment continues to speak as of the date of the Original Filing, and the Company has not updated the disclosure contained herein to reflect events that have occurred since the date of the Original Filing. Accordingly, this Amendment should be read in conjunction with the Company’s other filings made with the SEC subsequent to the filing of the Original Filing, including any amendments to those filings.

WESTELL TECHNOLOGIES, INC.

2015 ANNUAL REPORT ON FORM 10-K/A CONTENTS

|

| | |

| | Page |

Item | | |

1. | | |

1A. | | |

1B. | | |

2. | | |

3. | | |

4. | | |

| | |

| | |

5. | | |

6. | | |

7. | | |

7A. | | |

8. | | |

9. | | |

9A. | | |

9B. | | |

| | |

| | |

10. | | |

11. | | |

12. | | |

13. | | |

14. | | |

| | |

| | |

15. | | |

| | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements contained herein that are not historical facts or that contain the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “may,” “will,” “plan,” “should,” or derivatives thereof and other words of similar meaning are forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed in or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, product demand and market acceptance risks, customer spending patterns, need for financing and capital, economic weakness in the United States (U.S.) economy and telecommunications market, the effect of international economic conditions and trade, legal, social and economic risks (such as import, licensing and trade restrictions), the impact of competitive products or technologies, competitive pricing pressures, customer product selection decisions, product cost increases, component supply shortages, new product development, excess and obsolete inventory, commercialization and technological delays or difficulties (including delays or difficulties in developing, producing, testing and selling new products and technologies), the ability to successfully consolidate and rationalize operations, the ability to successfully identify, acquire and integrate acquisitions, effects of the Company’s accounting policies, retention of key personnel and other risks more fully described in this Form 10-K/A for the fiscal year ended March 31, 2015, under Item 1A—Risk Factors. The Company undertakes no obligation to publicly update these forward-looking statements to reflect current events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or otherwise.

Trademarks

The following terms used in this filing are our trademarks: ClearLink®, Kentrox®, Optima Management System®,

UDIT®, WESTELL TECHNOLOGIES®, and Westell®. All other trademarks appearing in this filing are the property of their holders.

PART I

Overview

Westell Technologies, Inc., (the Company) is a leading provider of in-building wireless, intelligent site management, cell site optimization, and outside plant solutions focused on innovation and differentiation at the edge of telecommunication networks, where end users connect. The Company’s comprehensive set of products and solutions are designed to advance network performance for carriers, integrators, and other network operators, allowing them to reduce operating costs and improve network performance. With millions of products successfully deployed worldwide, the Company is a trusted partner for transforming networks into high performance, reliable systems.

The Company's two business segments, In-Building Wireless and Communication Solutions Group, are engaged in the design, development, assembly, and marketing of a wide variety of products and solutions. Segment financial information is set forth in the Notes to the Consolidated Financial Statements.

In-Building Wireless (IBW) Segment

The IBW segment solutions include distributed antenna systems (DAS) conditioners, high-performance digital repeaters and bi-directional amplifiers (BDAs), and system components and antennas, all used by wireless service providers and neutral-party hosts to fine tune radio frequency (RF) signals that helps extend coverage to areas not served well or at all by traditional cell sites.

Communication Solutions Group (CSG) Segment

The CSG segment solutions include intelligent site management (ISM), cell site optimization (CSO), and outside plant (OSP) as follows:

• ISM solutions include a suite of Remote monitoring and control devices which, when combined with the Company's Optima management system, provides comprehensive machine-to-machine (M2M) communications that enable operators to remotely monitor, manage, and control site infrastructure and support systems.

• CSO solutions consist of tower mounted amplifiers (TMAs), small outdoor-hardened units mounted next to antennas on cell towers, enabling wireless service providers to improve the overall performance of a cell site, including increasing data throughput and reducing dropped connections.

• OSP solutions, which are sold to wireline and wireless service providers as well as industrial network operators, consist of a broad range of offerings, including cabinets, enclosures, and mountings; synchronous optical networks/time

division multiplexing (SONET/TDM) network interface units; power distribution units; copper and fiber connectivity panels; hardened Ethernet switches; and systems integration services.

Industry Trends and Market Solutions

In-Building Wireless

In-building wireless solutions, including DAS and small cell installations, have increased dramatically in the last decade, driven by the trend for voice and data traffic to move from the outdoor macro environment to indoors. Current projections show that over 80% of all voice and data traffic is now handled from within buildings. This trend is likely to continue to grow as more people use mobile devices and data-intensive services in areas such as stadiums, universities, airports, and office buildings. As the number of systems and users continues to increase, the greater the demand for a reliable network that can manage the increased coverage and capacity requirements.

Our in-building wireless solutions, which include our internally-developed DAS conditioners and the comprehensive suite of products acquired with the addition of Cellular Specialties, Inc. (CSI) on March 1, 2014, provide wireless service providers with a broad set of solutions to help meet growing market demand. These solutions include:

•DAS conditioners: These units interconnect the wireless base transceiver system (BTS) to the DAS head-end while conditioning signals. Active systems can also monitor and control RF performance (e.g. the BTS power coming into the DAS). Both our passive and active devices can accommodate all of the major wireless service provider frequency bands, with numerous port configuration options. Our Universal DAS Interface Unit (UDIT), an active, remotely manageable, high density, space saving unit with advanced features like spectrum analysis and tone generators to help test and analyze signal measurement data has just recently been made available.

•High performance digital repeaters and bi-directional amplifiers (BDAs): These units provide a means to amplify and appropriately filter the RF signal from a cell site, providing the additional power and improved signal to noise performance necessary to optimize wireless service seamlessly throughout a building or structure.

•System components and antennas: We offer a variety of passive system components (couplers, dividers, and tappers) for use in DAS and in-building wireless systems to direct and condition energy flow for specific frequency bands. We also offer a broad line of antennas to support in-building wireless communication.

Our in-building wireless solutions improve network performance, provide real-time monitoring and management to reduce troubleshooting time, and minimize operating and capital costs.

Intelligent Site Management

Telecommunication service providers and cell tower operators were initially focused on network coverage. Priority then moved to network availability. With the migration to long-term evolution (LTE) and 4th generation (4G) networks, capacity is now a primary concern. With this shifting of requirements to managing faster speeds and higher capacity, more intelligence is moving to the network edge (e.g., cell sites and in-building systems). This has increased the importance of the edge support infrastructure such as environmental controls, power systems, and security.

Our ISM solutions, acquired with the addition of Kentrox on April 1, 2013, provide comprehensive M2M communication, enabling operators to remotely monitor, manage, and control critical infrastructure and ensure the continued health and success of the network. The four important areas of focus include:

•Environmental management: heating, ventilation, and air conditioning (HVAC) monitoring/energy monitoring/control, environmental monitoring, and aircraft warning light (AWL) management.

•Power management: AC and DC power monitoring, AWL management, battery monitoring, fuel monitoring, generator management, hybrid power management, rectifier monitoring, and tenant power monitoring.

•Security management: access management, asset tampering, and surveillance management.

•Communications management: microwave, DAS, and small cell management.

The comprehensive ISM solution features the Kentrox Remote suite of products and the Optima management system for a complete view and understanding of site assets remotely (i.e., without a site visit). This enables the ability to more cost-effectively monitor, troubleshoot, and correct problems with network infrastructure before service affecting outages occur.

Our ISM solutions reduce network operating costs; improve network performance, including quality, reliability, and availability; and improve site security.

Cell Site Optimization

The expansion of LTE and 4G mobile networks and the introduction of enhanced wireless services and devices are causing a greater demand for higher network throughput. At the same time, mobile users expect a quality experience every time they use a device, whether in a city or driving in remote areas. This is forcing wireless service providers to optimize their networks by optimizing the cell site coverage area and increasing RF data throughput. CSO is critical, and TMAs have become increasingly popular to enhance the RF signal performance and improve the end users quality of service, while using the existing network infrastructure.

We provide a comprehensive range of TMAs that enables wireless service providers to improve CSO by boosting the RF signal performance from mobile devices. Our single band and multi band TMAs provide one of the lowest noise figures in the industry, are a highly reliable and proven technology, and provide very low passive intermodulation distortion and bypass loss. In the unlikely event of a TMA failure, it automatically switches to bypass mode, ensuring network availability.

We also provide turnkey services solution for optimizing RF signal performance. From sourcing, configuration, engineering, project management, deployment, turn-up, training, to follow on support, wireless service providers can be ensured a quality and timely implementation to meet their requirements.

Our CSO solutions improve network quality and capacity, expand the coverage area, increase data throughput, and improve the end users wireless experience.

Outside Plant

Building a communications network that can sustain harsh environmental conditions while providing the required reliability to keep customers happy can be a challenge, especially while trying to minimize costs. Whether it’s an industrial, utility, transportation, or telecommunications network, the connections between devices must effectively, efficiently, and safely carry and process signals throughout the infrastructure (cables, racks, enclosures, power distribution, etc.) while providing remote management capabilities.

We provide a comprehensive range of outside plant solutions to connect nearly any outdoor building or facility, including:

•Power Distribution: Includes fuse panels and breaker panels for installation in equipment racks to connect up to bulk power circuits and distribute power to other equipment via individual power feeds.

•Copper/Fiber Connectivity: A flexible portfolio of standard relay rack mount panels and wall mount enclosures for Ethernet, fiber, or coax cables to facilitate easy and simple splicing, terminations, or handoffs.

•Ethernet Solutions: Includes industrial-hardened, multiport, remotely-managed Ethernet switches with a variety of port count and connectivity options (both fiber and copper), including models with advanced powering and site telemetry features.

•SONET/TDM Solutions: Includes network interface devices with performance monitoring features, line repeaters, and protection panels.

•Cabinets, Enclosures, and Mountings: Includes outdoor cabinets for sheltering equipment and maintaining proper operating temperature, enclosures for protecting equipment, and prewired mountings to accommodate plug-in cards.

•Systems Integration Services: A one-stop shop for complete turnkey solutions of customer-specified equipment installed in the Company’s cabinet or enclosure.

Our OSP solutions help service providers reduce operating costs, increase network quality and availability, improve time to market, and minimize capital costs while improving technician efficiency.

Recent Acquisitions

Acquisition of Cellular Specialties, Inc.

On March 1, 2014, the Company acquired 100% of Cellular Specialties, Inc. (CSI) stock for $39.0 million in cash plus a $5.0 million working capital adjustment. CSI, based in Manchester, New Hampshire, is an industry leader in the design and development of in-building wireless solutions including products for distributed antenna systems (DAS) installations, high-performance digital repeaters, and system components and antennas. The assets and liabilities acquired and the results of operations relating to CSI are included in the Company's Consolidated Financial Statements from the date of acquisition.

Acquisition of Kentrox, Inc.

On April 1, 2013, the Company acquired 100% of Kentrox, Inc. stock for $30.0 million in cash, subject to working capital adjustments and escrow provisions. Kentrox, based in Dublin, Ohio, is a worldwide leader in intelligent site management solutions, providing comprehensive M2M communications that enable operators to remotely monitor, manage, and control site support systems, reducing their operating costs while improving site performance and security. The assets and liabilities acquired and the results of operations relating to Kentrox are included in the Company's Consolidated Financial Statements from the date of acquisition.

Acquisition of certain assets and liabilities of ANTONE Wireless Corporation

On May 15, 2012, the Company acquired certain assets and liabilities of the ANTONE Wireless Corporation, based in Goleta, California, including rights to ANTONE products, for $2.5 million in cash, subject to working capital adjustments, plus contingent cash consideration of up to $3.5 million. The acquisition included inventories, property and equipment, contract rights, intangible assets, and certain specified operating liabilities that existed at the acquisition date. ANTONE products included tower mounted amplifiers (TMAs) and antenna sharing products. The contingent cash consideration is based upon profitability of the acquired products through June 30, 2016. The assets and liabilities acquired and the results of operations relating to ANTONE are included in the Company's Consolidated Financial Statements from the date of acquisition.

Customers

The Company's principal customers include telecommunications service providers, systems integrators, cell tower operators, and distributors. Telecommunication service providers include wireless and wireline service providers, multiple systems operators (MSOs), and Internet service providers.

Continuous industry consolidation among North American telecommunication service providers has reduced the number of customers for our solutions and products. As a result, the Company depends on fewer but larger customers for the majority of its revenues. The Company’s largest customer, Verizon, accounted for 30.5% of the Company's total revenues in fiscal year 2015.

While the Company historically has served customers predominantly in North America (U.S. and Canada), starting fiscal year 2014, as a result of the Kentrox acquisition, the Company had revenue with customers in Australia, South Africa, and Latin America. Customers outside North America represented approximately $3.7 million, $9.9 million and $2.4 million of the Company’s revenues in fiscal years 2015, 2014, and 2013, respectively, which represents approximately 4.4%, 9.7% and 6.2% of the Company's total revenues in such years.

Sales and Customer Support

We sell our solutions and products through our field sales organization, distributors, and partners. Customer contracts are primarily pricing and technical specification agreements that detail the commercial terms and conditions for sales. These agreements typically do not obligate the customer to a specific volume of purchases over time. The agreements may require the Company to accept returns of products within certain time limits, or indemnify customers against certain liabilities arising out of the use of the Company's solutions and products. If these claims or returns are significant, there could be a material adverse effect on the Company's business and results of operations.

In many instances, customers require vendor approval before deployment of solutions and products in their networks. Evaluation can take as little as a few months for products, but often longer for new solutions, products, and technologies. Accordingly, the Company is continually submitting successive generations of its current solutions and products, as well as new offerings, to its customers for approval.

We provide customer support, technical consulting, research assistance and training to some of our customers with respect to the installation, operation and maintenance of our products.

Most of our solutions and products carry a limited warranty ranging from one to seven years, which generally covers defects in materials or workmanship and failure to meet published specifications, but excludes damages caused by improper use. In the event there are material deficiencies or defects in our design or manufacture, the affected solutions and products could be subject to recall.

Supply Chain

We outsource the majority of our manufacturing to both domestic and international suppliers. Some CSG segment products such as TMAs, power distribution panels, and cabinet integration undergo final top-level assembly and testing at our Aurora, Illinois facility; and most IBW segment products undergo final top-level assembly and testing in Manchester, New Hampshire.

Reliance on third-party contract manufacturers (CMs) involves risks. Standard commercial components available from multiple suppliers are procured by the CMs. In some cases, where there are single-sourced components and technology needed, the Company has direct supplier relationships and contracts for these items, and may maintain inventory for these items at the CMs locations. Critical components, technology shortages, or business interruptions at our CMs could cause delays that may result in expediting costs or lost business.

A substantial portion of the Company's shipments in any fiscal period can relate to orders received in that period. Further, a significant percentage of orders may require delivery within forty-eight hours. To meet this demand, we maintain inventory at our facilities and at customer sites. Because of rapid technological changes, we face recurring risks that our inventory may become obsolete.

Research and Development

We believe our ability to maintain technological capabilities through enhancements of existing offerings and development of new solutions and products that meet customer needs is a critical component for success. We therefore expect to continue to devote substantial resources to research and development (R&D). In fiscal years 2015, 2014 and 2013, the Company's R&D expenses were approximately $17.3 million, $11.3 million, and $5.9 million, respectively.

The Company's R&D personnel are organized into teams, each responsible for sustaining technical support of existing solutions and products, conceiving new products in cooperation with other groups within the Company, and adapting standard products or technologies to meet new customer needs. Additionally, in an effort to remain a highly valued, superior quality, long-term supplier, each team is charged with reducing product costs for each succeeding generation of products without compromising functionality or serviceability. The teams leverage the Company’s relationships with its CMs and suppliers to achieve these cost reduction objectives.

We believe that the key to our R&D strategy is choosing an initial architecture for each product that balances innovation and time-to-market factors while enabling engineering innovations to result in future performance enhancements and cost reductions. The Company’s strategy is further enhanced by ensuring products are designed in conjunction with input from customers, procurement, CMs, and suppliers.

Our quality systems in the CSG segment, including product development processes, are registered to ISO9001:2008 International Quality System Standard and TL9000, which is the Telecommunication Industry's sector-specific version of the ISO9001:2008. The IBW facility is developing quality management systems with focus on registration to the ISO 9001:2008 and TL9000 standards. Many current critical processes required for managing the full product life cycle are already in place. Analysis of process and product performance, as well as monitoring of customer satisfaction and perception of IBW products and performance, are routinely reviewed and corrective actions taken where applicable. IBW successfully maintains TUV CE registration through quarterly audits in support of critical customer product offerings. Product realization is accomplished as required in the ISO 9001:2008 standard. Critical quality assurance processes such as calibration, control of nonconforming material, supplier evaluation and monitoring, and configuration management are all in place and audited routinely to insure the best product offerings possible to the customer. We believe product quality and reliability are critical and distinguishing factors in a customer’s selection process.

The Company’s products are subject to industry-wide standardization organizations, including Telcordia, the Internet Engineering Task Force, the Metro Ethernet Forum, the American National Standards Institute (ANSI) in the U.S. and the International Telecommunications Union (ITU).

Competition

We operate in an intensely competitive marketplace and have no reason to believe that this competitive environment will ease in the future. Our customers base their purchasing decisions on multiple factors including features, quality, performance, price, total cost of ownership, reliability, responsiveness, incumbency, financial stability, reputation, and customer service. While competitors vary by market, some of our primary competitors include Asentria, CCI, Charles Industries, CommScope, Corning, DPS Telecom, Emerson, Inala, Invendis Quest Controls, Purcell, Ruggedcom, TE Connectivity, and Telect. Some of these competitors compete with us across several of our solutions and products while many are a competitor to a specific solution or product.

Intellectual Property

The Company’s success depends, in part, on its ability to protect trade secrets, obtain or license patents, and operate without infringing on the rights of others. We rely on a combination of technical leadership, copyrights, trademarks, trade secrets, nondisclosure agreements, and other intellectual property and protective measures to secure our proprietary know-how. The expiration of any of the patents held by the Company would not have a material impact on the Company. From time to time, the Company expects to seek additional patents related to its R&D activities.

Backlog

Product shipments are generally made pursuant to standard purchase orders, which are officially acknowledged according to standard terms and conditions. Seasonality may cause revenue to differ from quarter to quarter. The CSG segment sells equipment that is installed outdoors and the ordering of such equipment declines during and in advance of the colder months. Budget cycles for our customers may also contribute to revenue variability in those same periods. Purchase orders are generally received less than a month prior to shipment.

As of May 14, 2015, and May 14, 2014, the IBW segment had $2.7 million and $1.3 million of backlog, respectively and the CSG segment had $11.4 million and $7.0 million, respectively.

Employees

As of May 1, 2015, the Company had 232 full-time employees. The following table reflects headcount by fiscal year 2016 segment and functional area.

|

| | | | | | | | | | | |

| IBW | | CSG | | Corporate | | Total |

Operations | 27 |

| | 46 |

| | — |

| | 73 |

|

Sales and marketing | — |

| | — |

| | 53 |

| | 53 |

|

Research and development | 40 |

| | 35 |

| | — |

| | 75 |

|

General and administrative | — |

| | — |

| | 31 |

| | 31 |

|

Total employees | 67 |

| | 81 |

| | 84 |

| | 232 |

|

Available Information

The SEC maintains an internet site, www.sec.gov, through which you may access the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy and other information statements, as well as amendments to these reports. In addition, the Company makes these reports available free of charge on the Company’s internet website, www.westell.com. The Company maintains a corporate governance page on the Company’s website. This page includes, among other items, the Code of Business Conduct, the Audit Committee Charter, the Compensation Committee Charter and the Corporate Governance and Nominating Committee Charter.

You should carefully consider the risks described below in addition to the other information contained and incorporated by reference in this Form 10-K/A. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us, or those risks we currently view to be immaterial, may also materially and adversely affect our business, operating results or financial condition. If any of these risks materialize, our business, operating results or financial condition could be materially and adversely affected.

Risks Related to Our Business

We have incurred losses in the past and may incur losses in the future.

We have incurred losses in recent fiscal years and historically in fiscal years through 2002. The Company had an accumulated deficit of $297.4 million as of March 31, 2015.

We also expect to continue to evaluate new product and growth opportunities. As a result, we will continue to invest in research and development and sales and marketing, which could adversely affect our short-term operating results. We cannot provide any certainty that we will be profitable in the future.

We depend on a limited number of customers who are able to exert a high degree of influence over us and loss or the reduction of spending of a major customer could adversely impact our business.

We have and may continue to depend on U.S. telecommunication service providers for the majority of our revenues. The telecommunications companies and our other customers are significantly larger than we are and are able to exert a high degree of influence over us. Customers may often be permitted to reschedule orders without penalty. Even if demand for our products is high, many telecommunication service providers have sufficient bargaining power to demand low prices and other terms and conditions that may materially adversely affect our business and operating results.

Our performance is dependent on customer capital spending, which can be volatile and difficult to forecast. Customer capital spending can be affected by end user demand driven by competing technology, economic conditions, customer budget restraints, work stoppages or other labor issues at the facilities at our customers and other factors. Our customers have curtailed or deferred spending in the past without notice.

Overall sales and product mix sold to our large customers have fluctuated in the past and could vary in the future resulting in significant fluctuations in quarterly operating results and may also adversely impact our stock price.

We have completed acquisitions and may engage in future acquisitions that could impact our financial results or stock price.

We recently completed acquisitions and expect to continue to review potential acquisitions, and we may acquire or make investments in businesses, products or technologies in the future. Any existing or substantial future acquisitions or investments would present a number of risks that could harm our business including:

| |

• | business integration issues; |

| |

• | disruption to our ongoing or our acquired business; |

| |

• | difficulty realizing the intended benefits of the transaction; |

| |

• | impairment of assets related to acquired goodwill and intangibles; and |

Future acquisitions or investments could also result in use of significant cash balances, potential dilutive issuances of equity securities or incurrence of debt, contingent liabilities or amortization expenses related to goodwill and other intangible assets, any of which could adversely affect our financial condition and results of operations.

We have long-term customer pricing contracts with a limited amount of coverage by way of long-term contracts or arrangements with suppliers, which could adversely affect our ability, with certainty or economically, to purchase components and technologies used in our products.

Although we have long-term customer pricing contracts, we have few long-term contracts or arrangements with our suppliers. We may not be able to obtain products or components at competitive prices, in sufficient quantities or under other commercially reasonable terms. We may be unable to pass any significant increase in product costs on to our customers, which could have an adverse impact on our financial results.

Our lack of backlog may affect our ability to adjust for unexpected changes in customer demand.

Customers often place orders for product within the month of their requested delivery date. We therefore typically do not have a material backlog (or known quantity) of unfilled orders, and our revenues in any quarter are substantially dependent on orders booked or orders becoming non-cancellable in that quarter. Our expense levels and inventory commitments are based on anticipated customer demand and are relatively fixed in the short term. If we enter into a high-volume or long-term supply arrangement and subsequently decide that we cannot use the products or services provided for in the supply arrangement then our business would also be harmed. We enter into short-term contracts with our suppliers in the form of purchase orders. These purchase orders are issued to vendors based on forecasted customer demand. Therefore, we may be unable to cancel purchase orders with our suppliers or adjust spending in a timely manner to compensate for any unexpected shortfall of orders. Accordingly, any significant shortfall of demand in relation to our expectations or any material delay of customer orders could have an adverse impact on our business, operating and financial results.

We face significant inventory risk

We are exposed to significant inventory risks that may adversely affect our operating results as a result of seasonality, new product launches, rapid changes in product cycles and pricing, defective products, changes in customer demand and spending patterns, and other factors. We endeavor to accurately predict these trends and avoid over-stocking or under-stocking products we assemble and/or sell. Demand for products, however, can change significantly between the time inventory or components are ordered/assembled and the date of customer orders. In addition, when we begin marketing a new product, it may be difficult to determine appropriate product or component selection, and accurately forecast demand. The acquisition of certain types of inventory or components may require significant lead-time and they may not be returnable. We carry a broad selection and significant inventory levels of certain products, and we may be unable to sell products in sufficient quantities. Any one of the inventory risk factors set forth above may adversely affect our operating results.

Conversely, if we order too little product to meet customer demand, we may have insufficient inventory which could result in unplanned expediting costs or lost revenue opportunities, either of which could have an adverse impact on our financial results.

We may experience delays in the development and deployment of new products.

Many of our past sales have resulted from our ability to anticipate changes in technology, industry standards and service provider service offerings, and to develop and introduce new and enhanced products and services. Our continued ability to adapt to such changes will be a significant factor in maintaining or improving our competitive position and our prospects for growth.

There can be no assurance that we will successfully introduce new products on a timely basis or achieve sales of new products in the future. In addition, there can be no assurance that we will have the financial and product design resources necessary to continue to successfully develop new products or to otherwise successfully respond to changing technology standards and service provider service offerings. If we fail to deploy new products on a timely basis, then our product sales will decrease and our competitive position and financial condition would be materially and adversely affected.

Our customers have lengthy purchase cycles and unpredictable purchasing practices that affect our ability to sell our products.

Prior to selling products to service providers, we must undergo lengthy approval and purchase processes. Evaluation can take as little as a few months for products that vary slightly from existing products or up to a year or more for products based on new technologies or utilized for new service offerings. Customers may also choose not to utilize our offerings. Accordingly, we are continually submitting successive generations of our current products as well as new products to our customers for approval.

The requirement that service providers obtain FCC or state regulatory approval for most new telecommunications and broadband services prior to their implementation has in the past delayed the approval process. Such delays in the future could have a material adverse effect on our business and operating results. While we have been successful in the past in obtaining product approvals from our customers, there is no guarantee that such approvals or that ensuing sales of such products will continue to occur.

Our business is subject to the risks of international operations.

We are dependent on our independent offshore manufacturing partners in Asia to manufacture, assemble and test our products. Although there typically is no unique capability with these suppliers, any failure or business disruption by these suppliers to meet delivery commitments would cause us to delay shipments and potentially lose revenue and/or incur contractual penalties. The reliance on third-party subcontractors for assembly of our products involves several risks, including the unavailability of, or interruptions in access to, certain process technologies and reduced control over product quality, delivery schedules, transportation, manufacturing yields, and costs. These risks may be exacerbated by economic or political uncertainties, terrorist actions, or by natural pandemics or other disasters in countries in which our subcontractors or their subcontractors are located. Contracts with our outsource manufacturing partners are generally expressed in U.S. dollars, but volatility in foreign currency rates could increase our costs.

We aim to derive an increased portion of our revenue from international operations. As a result, our financial condition and operating results could be significantly affected by risks associated with international activities, such as economic, political, and other risks and uncertainties, including, but not limited to, regional or country specific economic downturns, tax laws, fluctuations in currency exchange rates, complications in complying with, or exposure to liability under, a variety of laws and regulations, including anti-corruption laws and regulations, political instability and significant natural disasters and other events or factors impacting local infrastructure. Requirements for international expansion may increase our operating expenses or working capital needs.

Due to the rapid pace of technological change and volatile customer demand, our products may become obsolete and could cause us to incur charges for excess and obsolete inventory which would materially harm our business.

The telecommunications industry is subject to rapid technological change and volatile customer demands, which affected our past results and could result in inventory obsolescence or excess inventory. We have in the past and may in the future devote disproportionate resources to a product that we ultimately may not sell or have to sell for a loss. If we incur substantial inventory impairments that we are not able to recover because of changing market conditions, or if we commit resources that do not result in profitable sales, there could be a material adverse effect on our business, financial condition and results of operations.

Our products and services face intense competition. Our failure to compete successfully could materially affect our profitability.

Because we are smaller than many of our competitors, we may lack the financial, marketing, technical and other resources needed to increase or maintain our market share. Many of our competitors are larger than we are and may be able to offer a wider array of products and services required for a service provider’s business than we do.

Competitors may succeed in establishing more technologically advanced products and services, or products with more favorable pricing or may otherwise gain an advantage over our products which would result in lost business that would adversely impact our profitability.

Because of intense competition, we may price our products and services at low margins in order to win or maintain business. Low margins from our sales of products and services could materially and adversely affect our profitability and ability to achieve our business goals.

We are dependent on third-party technology, the loss of which would harm our business.

We rely on third parties for technology in our products. Consequently, the Company must rely upon third parties to develop and to introduce technologies which enhance the Company's current products and enable the Company, in turn, to develop its own products on a timely and cost-effective basis to meet changing customer needs and technological trends in the telecommunications industry. Were the Company to lose the ability to obtain needed technology from a supplier, or were that technology no longer available to the Company under reasonable terms and conditions, the Company’s business and results of operations could be materially and adversely affected.

Potential product recalls, service failures and warranty expenses could adversely affect our profitability.

Our products are required to meet rigorous standards imposed by our customers, and we warrant the performance of these products and services. In addition, our supply contracts with our major customers typically require us to accept returns of products within certain time frames and indemnify such customers against certain liabilities arising out of the use of our products or services. Complex products such as those offered by us may contain undetected defects or failures when first introduced or as new versions are released. Despite our testing of products and our comprehensive quality control program, there is no guarantee that our products will not suffer from defects or other deficiencies. If product defects, recalls, warranty returns, failures, indemnification or liquidated-damage claims exceed our anticipated costs for these items, our business could be harmed. Such claims and the associated negative publicity could result in the loss of or delay in market acceptance of our products and services, and could affect our product sales, our customer relationships, and our profitability.

We are dependent on sole or limited source suppliers, the loss of which would harm our business.

Components used in our products may be currently available from only one source or a limited number of suppliers. Our inabilities to obtain sufficient key components or to develop alternative sources for key components as required, could result in delays or reductions in product deliveries, and consequently severely harm our customer relationships and our business. Furthermore, additional sole-source components may be incorporated into our future products, thereby increasing our supplier risks. If any of our sole-source suppliers delay or halt production of any of their components, or fail to supply their components on commercially reasonable terms, then our business and operating results would be harmed.

In the event that these suppliers discontinue the manufacture of materials used in our products, we would be forced to incur the time and expense of finding a new supplier, if available, or to modify our products in such a way that such materials were not necessary, which could result in increased manufacturing costs.

New regulations related to conflict minerals could adversely impact our business.

The Dodd-Frank Wall Street Reform and Consumer Protection Act contains provisions concerning the supply of “conflict” minerals mined from the Democratic Republic of Congo and adjoining countries (DRC). As a result, the SEC established annual disclosure and reporting requirements for those companies who may use conflict minerals sourced from the DRC in their products. There will be costs associated with complying with these disclosure requirements, including diligence costs to determine the sources of conflict minerals used in our products. These new requirements also could limit the pool of suppliers who can provide conflict-free minerals and, as a result, we cannot ensure that we will be able to obtain these minerals at competitive prices. In addition, we may face challenges with our customers or with our reputation if we determine that certain of our products contain minerals not determined to be conflict free or if we are unable to sufficiently verify the origins of the minerals used in our products.

We may be subject to litigation that could be costly to defend and could impact our profitability.

Our products use third party and open source intellectual property. The telecommunications industry is characterized by the existence of an increasing number of patents and frequent litigation based on allegations of patent and other intellectual property infringement. From time to time we receive communications from third parties alleging infringement of exclusive patent, copyright and other intellectual property rights to technologies that are important to us. Such litigation, regardless of its outcome, could result in substantial costs and thus adversely impact our profitability. We could face securities litigation or other litigation that could result in the payment of substantial damages or settlement costs in excess of our insurance coverage. Any adverse outcome could harm our business. Even if we were to prevail in any such litigation, we could incur substantial legal costs and management's attention and resources could be diverted from our business which could cause our business to suffer.

We will not be able to successfully compete, develop and sell products and services if we fail to retain key personnel and hire additional key personnel.

Because of our need to continually compete for customer business, our success is dependent on our ability to attract and retain qualified technical, marketing, sales and management personnel. To remain competitive, we must maintain top management talent, employees who are involved in product development and testing and employees who have developed strong customer relationships. Because of the high demand for these types of employees, it may be difficult to retain existing key employees and attract new key employees. In addition, we do not have non-compete contracts with most of our employees. Our inability to attract and retain key employees could harm our ability to successfully sell existing products, develop new products, and implement our business goals.

Industry consolidation and divestiture could make competing more difficult.

Consolidation of companies offering competing products is occurring through acquisitions, joint ventures and licensing arrangements involving our competitors, our customers and our customers’ competitors.

Our customers may acquire, merge or divest territories to other telecommunication service providers. The acquiring companies often use competitor products in their legacy business. We are often required to formally bid to retain existing business or obtain new business in the acquirer’s territory.

We cannot provide any assurances that we will be able to compete successfully in an increasingly consolidated telecommunications industry or retain or win business when existing customers divest portions of their business to others. Any heightened competitive pressures that we may face may have a material adverse effect on our business, prospects, financial condition and results of operations.

Utilization of our deferred tax assets could be limited by an ownership change as defined by Section 382 of the Internal Revenue Code, or by a change in the tax code, or by our ability to generate future taxable income.

We have significant deferred tax assets, primarily in the form of net operating losses, which are generally available to offset future taxable income. If we fail to generate sufficient future taxable income, net operating losses would expire prior to utilization. A valuation allowance was recorded against all deferred tax assets in the fourth quarter of fiscal year 2013. A change in ownership, as defined by Section 382 of the Internal Revenue Code, could reduce the availability of those tax assets. In addition, some tax jurisdictions such as Illinois and California have suspended the use of net operating losses to offset future taxable income for certain years. Additional federal or state tax code changes could further limit our use of deferred tax assets and harm our business and our investors.

We have and may incur liabilities in connection with the sale of certain assets and discontinued operations.

In connection with our divestitures, we have agreed to indemnify parties against specified losses with respect to those transactions and retained responsibility for various legal liabilities that may accrue. The indemnities relate to, among other things, liabilities which may arise with respect to the period during which we operated the divested business, and to certain ongoing contractual relationships and entitlements with respect to which we made commitments in connection with the divestiture. We have incurred and may incur additional expenses defending indemnity and third party claims. These added expenses to resolve the claim or to defend against the third party action could harm our operating results. In addition, such claims may divert management attention from our continuing business. It may also be difficult to determine whether a claim from a third party stemmed from actions taken by us or by another party and we may expend substantial resources trying to determine which party has responsibility for the claim.

Any restructuring activities that we have undertaken and may undertake in the future may not achieve the benefits anticipated and could result in additional unanticipated costs, which could have a material adverse effect on our business, financial condition, cash flows or results of operations.

In order to align our resources with our growth strategies, operate more efficiently and control costs, we have periodically announced restructuring plans, which include workforce reductions, facility closures and consolidations, asset impairments and other cost reduction initiatives. We regularly evaluate our existing operations and, as a result of such evaluations, may undertake additional restructuring activities within our business. These restructuring activities may involve higher costs or longer timetables than we anticipate, including costs related to severance and other employee-related matters, litigation risks and expenses, and other costs. These restructuring activities may disrupt sales or operations and may not result in improvements in future financial performance. If we incur unanticipated costs or are unable to realize the benefits related to restructuring activities, the activities could have a material adverse effect on our business, financial condition, cash flows or results of operations.

An impairment of goodwill or other intangible assets could adversely impact our reported financial results.

At least annually, we are required to test our goodwill to determine if impairment has occurred. Events or circumstances could arise that may create a need to record an impairment adjustment related to our goodwill or other intangible assets that could adversely impact our reported financial results. Goodwill impairment charges were recorded in fiscal years 2013 and 2015 that reduced goodwill balances existing at that time to zero.

Our business may be affected by uncertain government regulation, and current or future laws or regulations could restrict the way we operate our business or impose additional costs on our business.

The telecommunications industry, including most of our customers, is subject to regulation from federal and state agencies, including the FCC and various state public utility and service commissions. While most such regulations do not affect us directly, the effects of regulations on our customers may adversely impact our business and operating results. For example, FCC regulatory policies affecting the availability of telecommunication company services and other terms on which telecommunication companies conduct their business may impede our penetration of local access markets, and/or make the markets less financially attractive.

Risks Related to our Common Stock

Our stock price is volatile and could drop unexpectedly.

Our stock price has demonstrated and may continue to demonstrate volatility as valuations, trading volumes and prices vary significantly. Such volatility may result in a material decline in the market price of our securities, and may have little relationship to our financial results or prospects.

We could be the subject of future investigation by the SEC or other governmental authorities that could adversely affect our financial condition, results of operations and the price of our common stock.

In the event that an investigation by the SEC or other governmental authorities leads to significant legal expense or to action against the Company or its directors and officers, our financial condition, results of operations and the price of our common stock may be adversely impacted.

Our principal stockholders can exercise significant influence that could discourage transactions involving a change of control and may affect your ability to receive a premium for Class A Common Stock that you purchase.

As of May 14, 2015, as trustees of a voting trust dated February 23, 1994, (the Voting Trust) containing common stock held for the benefit of the Penny family, Robert C. Penny III, Robert W. Foskett and Patrick J. McDonough, Jr. have the exclusive power to vote over 50.5% of the votes entitled to be cast by the holders of our common stock. In addition, members of the Penny family who are beneficiaries under this Voting Trust are parties to a stock transfer restriction agreement which prohibits the beneficiaries from transferring any Class B Common Stock or their beneficial interests in the Voting Trust without first offering such Class B Common Stock to the other Penny family members. Certain Penny family members also own or are beneficiaries of trusts that own shares outside of the Voting Trust. As trustees of the Voting Trust and other trusts, Messrs. Penny, Foskett and McDonough, Jr. control 54.4% of the stock vote. Consequently, we are effectively under the control of Messrs. Penny, Foskett and McDonough, Jr., as trustees, who can effectively control the election of all of the directors and determine the outcome of most corporate transactions or other matters submitted to the stockholders for approval. Such control may have the effect of discouraging transactions involving an actual or potential change of control, including transactions in which the holders of Class A Common Stock might otherwise receive a premium for their shares over the then-current market price.

Our Class A Common Stock could be delisted from the NASDAQ Global Select Market.

NASDAQ has established certain standards for the continued listing of a security on the NASDAQ Global Select Market. The standards for continued listing include, among other things, that the minimum bid price for the listed securities be at least $1.00 per share. Although the Company is currently in compliance with the minimum bid price requirement, in the future we may not satisfy the NASDAQ’s continued listing standards. If we do not satisfy any of the NASDAQ’s continued listing standards, the Company’s Class A Common Stock could be delisted. Any such delisting could adversely affect the market liquidity of our Class A Common Stock and the market price of our Class A Common Stock could decrease. A delisting could adversely affect our ability to obtain financing for our operations and/or result in a loss of confidence by investors, customers, suppliers or employees.

|

| |

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

The Company leases the following real property:

|

| | | | | | | | | |

Location | | Purpose | | Square footage | | Termination year | | Segment |

Aurora, IL | | Corporate headquarters, office, CSG distribution and manufacturing | | 179,000 |

| | 2017 | | |

Regina, Saskatchewan, Canada | | Design center | | 2,500 |

| | 2017 | | CSG |

Dublin, OH | | Design center | | 9,465 |

| | 2019 | | CSG |

Manchester, NH | | IBW distribution and manufacturing | | 16,932 |

| | 2018 | | IBW |

Manchester, NH | | IBW office | | 19,525 |

| | 2018 | | IBW |

The Company consolidated office space in its corporate headquarters in March, 2015 and is utilizing 31,000 square feet of office space and 86,000 square feet of distribution and manufacturing space with 62,000 of office space vacant.

On April 1, 2013, as a result of the Kentrox acquisition, the Company acquired a sixteen acre parcel of land in Dublin, Ohio. The Company sold four acres in April 2015 and is marketing the remaining twelve acres for sale.

The Company is involved in various legal proceedings incidental to the Company’s business and its previously owned operations. In the ordinary course of our business, we are routinely audited and subject to inquiries by governmental and regulatory agencies. Although it is not possible to predict with certainty the outcome of these or other unresolved legal actions or the range of possible loss, management believes that the outcome of such proceedings will not have a material adverse effect on our consolidated operations or financial condition.

|

| |

ITEM 4. | MINE SAFETY DISCLOSURES |

Not Applicable.

PART II

|

| |

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Company’s Class A Common Stock is quoted on the NASDAQ Global Select Market under the symbol “WSTL”. The following table sets forth for the periods indicated the high and low sale prices for the Class A Common Stock as reported on the NASDAQ Global Select Market.

|

| | | | | | | |

| High | | Low |

Fiscal Year 2015 | | | |

First Quarter ended June 30, 2014 | $ | 3.99 |

| | $ | 2.21 |

|

Second Quarter ended September 30, 2014 | 2.59 |

| | 1.62 |

|

Third Quarter ended December 31, 2014 | 1.87 |

| | 1.22 |

|

Fourth Quarter ended March 31, 2015 | 1.60 |

| | 0.96 |

|

Fiscal Year 2014 | | | |

First Quarter ended June 30, 2013 | $ | 2.57 |

| | $ | 1.90 |

|

Second Quarter ended September 30, 2013 | 3.65 |

| | 2.35 |

|

Third Quarter ended December 31, 2013 | 4.90 |

| | 3.28 |

|

Fourth Quarter ended March 31, 2014 | 4.73 |

| | 3.27 |

|

As of May 14, 2015, there were approximately 448 holders of record of the outstanding shares of Class A Common Stock and five holders of record of Class B Common Stock.

During the fiscal year ended March 31, 2015, no equity securities of the Company were sold by the Company that were not registered under the Securities Act of 1933, as amended.

Dividends

The Company has never declared or paid cash dividends on its common stock and does not anticipate paying cash dividends in the foreseeable future.

Issuer Purchases of Equity Securities

The following table provides information about the Company’s repurchase activity for its Class A Common Stock during the three months ended March 31, 2015.

|

| | | | | | | | | | | | | |

Period | Total Number of Shares Purchased (a) | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Programs (b) | | Maximum Number (or Approximate Dollar Value) that May Yet Be Purchased Under the Programs (b) |

January 1-31, 2015 | — |

| | $ | — |

| | — |

| | $ | 112,741 |

|

February 1-28, 2015 | 69,661 |

| | $ | 1.4700 |

| | — |

| | $ | 112,741 |

|

March 1-31, 2015 | 46,711 |

| | $ | 1.4688 |

| | — |

| | $ | 112,741 |

|

Total | 116,372 |

| | $ | 1.4695 |

| | — |

| | $ | 112,741 |

|

| |

(a) | In the quarter ended March 31, 2015, the Company repurchased 116,372 shares from employees that were surrendered to satisfy the minimum statutory tax withholding obligations on the vesting of restricted stock units. These repurchases, which are not included in the authorized share repurchase program, had a weighted-average purchase price of $1.47 per share. |

| |

(b) | In August 2011, the Board of Directors authorized a share repurchase program whereby the Company could repurchase up to an additional aggregate of $20.0 million of its outstanding Class A Common Stock. There was approximately $0.1 million remaining under this program as of March 31, 2015. |

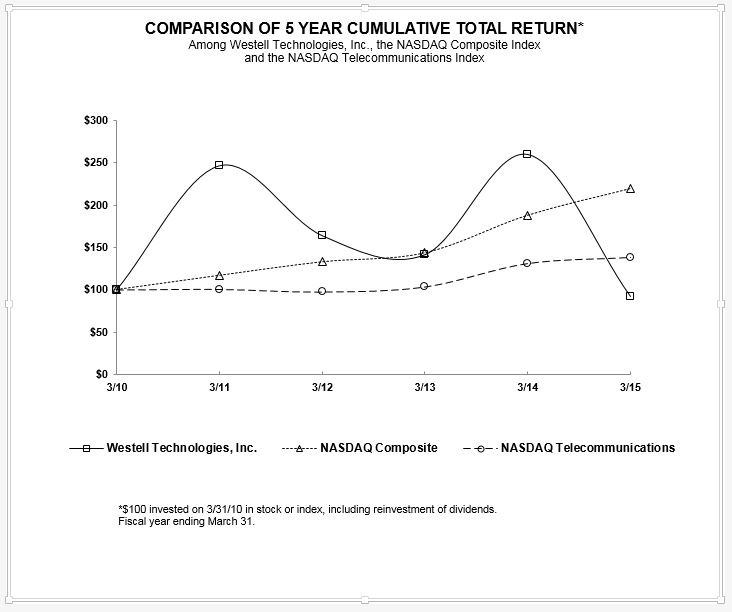

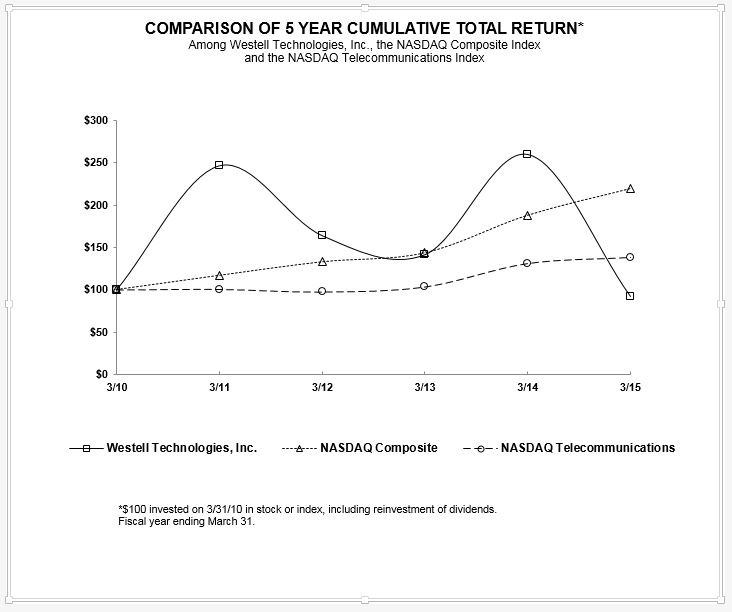

Performance Graph

The following performance graph compares the change in the Company’s cumulative total stockholder return on its Class A Common Stock with the cumulative total return of the NASDAQ Composite Index and the NASDAQ Telecommunications Index for the period commencing March 31, 2010 and ending March 31, 2015. The stock price performance shown in the performance graph may not be indicative of future stock performance price.

|

| | | | | | | | | | | | | | | | | |

| 3/10 | | 3/11 | | 3/12 | | 3/13 | | 3/14 | | 3/15 |

Westell Technologies, Inc. | 100.00 |

| | 246.48 |

| | 164.08 |

| | 141.55 |

| | 259.86 |

| | 92.25 |

|

NASDAQ Composite | 100.00 |

| | 116.88 |

| | 132.91 |

| | 143.55 |

| | 188.17 |

| | 219.78 |

|

NASDAQ Telecommunications | 100.00 |

| | 100.68 |

| | 97.60 |

| | 103.52 |

| | 130.88 |

| | 137.97 |

|

|

| |

ITEM 6. | SELECTED FINANCIAL DATA |

The following selected consolidated financial data as of March 31, 2015, 2014, 2013, 2012 and 2011 and for each of the five fiscal years in the period through fiscal year 2015 have been derived from the Company's Consolidated Financial Statements included in this amended filing and has been adjusted for the effects of the restatement as described in Note 1 to the Consolidated Financial Statements. The Company sold its ConferencePlus subsidiary in fiscal year 2012 and is reporting the results of ConferencePlus as discontinued operations. The Company discontinued the operations of the historical CNS segment in the first quarter of fiscal year 2014 and is reporting the CNS segment results as discontinued operations. The data set forth below is qualified by reference to, and should be read in conjunction with, "Management's Discussion and Analysis of

Financial Condition and Results of Operations”, the Consolidated Financial Statements and the related Notes thereto and other financial information appearing elsewhere in this Annual Report on Form 10-K/A.

|

| | | | | | | | | | | | | | | | | | | |

(in thousands, except per share data) | Fiscal Year Ended March 31, |

Statement of Operations Data: | 2015

(as restated (1)) | | 2014 (as restated and adjusted (1)(2)(3)) | | 2013

(as adjusted (3)) | | 2012

(as adjusted (3)) | | 2011

(as adjusted (3)) |

Revenue | $ | 84,127 |

| | $ | 102,073 |

| | $ | 38,808 |

| | $ | 43,629 |

| | $ | 58,770 |

|

Cost of revenue | 57,317 |

| | 61,612 |

| | 26,192 |

| | 27,144 |

| | 35,088 |

|

Gross profit | 26,810 |

| | 40,461 |

| | 12,616 |

| | 16,485 |

| | 23,682 |

|

Operating expenses: | | | | | | | | | |

Sales and marketing | 12,407 |

| | 13,304 |

| | 6,783 |

| | 5,156 |

| | 7,959 |

|

Research and development | 17,348 |

| | 11,339 |

| | 5,928 |

| | 5,460 |

| | 5,038 |

|

General and administrative | 14,678 |

| | 14,027 |

| | 9,310 |

| | 6,996 |

| | 8,623 |

|

Intangible amortization | 6,377 |

| | 4,889 |

| | 887 |

| | 544 |

| | — |

|

Restructuring | 3,243 |

| | 335 |

| | 149 |

| | 276 |

| | — |

|

Goodwill impairment | 31,997 |

| | — |

| | 2,884 |

| | — |

| | 540 |

|

Total operating expenses | 86,050 |

| | 43,894 |

| | 25,941 |

| | 18,432 |

| | 22,160 |

|

Operating income (loss) from continuing operations | (59,240 | ) | | (3,433 | ) | | (13,325 | ) | | (1,947 | ) | | 1,522 |

|

Other income (expense), net | (2 | ) | | (56 | ) | | 175 |

| | 331 |

| | 20 |

|

Income (loss) before income tax and before discontinued operations | (59,242 | ) | | (3,489 | ) | | (13,150 | ) | | (1,616 | ) | | 1,542 |

|

Income tax (expense) benefit | 201 |

| | 7,910 |

| | (29,392 | ) | | 686 |

| | 53,326 |

|

Net income (loss) from continuing operations | (59,041 | ) | | 4,421 |

| | (42,542 | ) | | (930 | ) | | 54,868 |

|

Income (loss) from discontinued operations, net of income tax | 139 |

| | (45 | ) | | (1,496 | ) | | 42,912 |

| | 13,068 |

|

Net income (loss) | $ | (58,902 | ) | | $ | 4,376 |

| | $ | (44,038 | ) | | $ | 41,982 |

| | $ | 67,936 |

|

Basic net income (loss) per share: | | | | | | | | | |

Basic net income (loss) from continuing operations | $ | (0.98 | ) | | $ | 0.08 |

| | $ | (0.71 | ) | | $ | (0.01 | ) | | $ | 0.81 |

|

Basic net income (loss) from discontinued operations | — |

| | — |

| | (0.02 | ) | | 0.64 |

| | 0.19 |

|

Basic net income (loss) per share (4) | $ | (0.98 | ) | | $ | 0.07 |

| | $ | (0.73 | ) | | $ | 0.63 |

| | $ | 1.00 |

|

Weighted average number of basic common shares outstanding | 59,985 |

| | 58,786 |

| | 59,944 |

| | 66,657 |

| | 67,848 |

|

Diluted net income (loss) per share: | | | | | | | | | |

Diluted net income (loss) from continuing operations | $ | (0.98 | ) | | $ | 0.07 |

| | $ | (0.71 | ) | | $ | (0.01 | ) | | $ | 0.79 |

|

Diluted net income (loss) from discontinued operations | — |

| | — |

| | (0.02 | ) | | 0.64 |

| | 0.19 |

|

Diluted net income (loss) per share | $ | (0.98 | ) | | $ | 0.07 |

| | $ | (0.73 | ) | | $ | 0.63 |

| | $ | 0.98 |

|

Weighted average number of diluted common shares outstanding | 59,985 |

| | 60,048 |

| | 59,944 |

| | 66,657 |

| | 69,477 |

|

Balance Sheet Data (at end of period): | | | | | | | | | |

Cash and cash equivalents | $ | 14,026 |

| | $ | 35,793 |

| | $ | 88,233 |

| | $ | 120,832 |

| | $ | 86,408 |

|

Working capital (5) | 18,295 |

| | 23,386 |

| | 12,637 |

| | 12,461 |

| | 29,457 |

|

Total assets | 100,377 |

| | 162,319 |

| | 142,437 |

| | 197,426 |

| | 201,387 |

|

Total stockholders’ equity | $ | 81,739 |

| | $ | 138,642 |

| | $ | 131,077 |

| | $ | 186,364 |

| | $ | 159,281 |

|

(1) Certain amounts have been restated to reflect adjustments related to the correction of an error (see Note 1 to the Consolidated Financial Statements for additional information).

(2) Certain amounts have been adjusted to reflect measurement period adjustments related to the CSI acquisition (see Note 2 to the Consolidated Financial Statements for additional information on recent acquisitions and divestitures).

(3) Certain amounts have been reclassified to reflect a change in accounting principle (see Note 1 to the Consolidated Financial Statements for additional information).

(4) Totals may not sum due to rounding.

(5) Working capital is defined as current assets less cash and cash equivalents, restricted cash, short-term investments and current liabilities.

|

| |

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview

The following discussion should be read together with the Consolidated Financial Statements and the related Notes thereto and other financial information appearing elsewhere in this Form 10-K/A. All references herein to the term “fiscal year” shall mean a year ended March 31 of the year specified. All of the financial information presented in this Item 7 has been revised to reflect the restatement of the consolidated financial statements more fully described in Note 1 to the Consolidated Financial Statements.

Westell Technologies, Inc., (the Company) is a leading provider of in-building wireless, intelligent site management, cell site optimization, and outside plant solutions focused on innovation and differentiation at the edge of telecommunication networks, where end users connect. The Company’s comprehensive set of products and solutions are designed to advance network performance for carriers, integrators, and other network operators, allowing them to reduce operating costs and improve network performance. With millions of products successfully deployed worldwide, the Company is a trusted partner for transforming networks into high performance, reliable systems.

The Company's two business segments, In-Building Wireless and Communication Solutions Group, are engaged in the design, development, assembly, and marketing of a wide variety of products and solutions.

Beginning in August 2014, the Company experienced significant reductions in customer capital spending, which adversely impacted the Company’s second and third quarter revenue, margins, and earnings in both segments. In this regard, when comparing the revenue from five customers in fiscal year 2014 to the same five customers in fiscal year 2015, the decline was 42%. While we expected customer capital spending to improve in the beginning of calendar 2015 (our fourth fiscal quarter), the customer spending has been slow to start thus far. Going forward, we expect customer capital spending to increase because end-user bandwidth needs continue to grow.

On January 30, 2015, the Company approved a plan to restructure its business, including reduction of headcount and consolidation of office space within the Aurora headquarters facility, with the intent to optimize operations. The restructuring was completed during the fourth quarter of fiscal year 2015 and impacted 17 employees. The Company recognized a restructuring expense of$3.2 million in the three months ended March 31, 2015, including a non-cash charge of $2.7 million in other associated costs related to a loss on a lease. The loss on the lease includes lease liabilities offset by estimated sublease income. The reorganization costs are expected to be paid by fiscal year 2018 concurrent with the termination date of the contractual lease.

In fiscal year 2015, the Company operated under two reportable segments: In-Building Wireless and Communication Solutions Group.

In-Building Wireless (IBW) Segment

The IBW segment solutions include distributed antenna systems (DAS) conditioners, high-performance digital repeaters and bi-directional amplifiers (BDAs), and system components and antennas, all used by wireless service providers and neutral-party hosts to fine tune radio frequency (RF) signals that helps extend coverage to areas not served well or at all by traditional cell sites. The IBW segment includes the comprehensive suite of products and solutions acquired with the addition of CSI, as well as our internally developed DAS interface panels. The CSI acquisition, which closed in March 2014, significantly expanded our product portfolio, enabling us to better compete in the growing in-building wireless market, where we expect to increase our revenue and profitability.

Communication Solutions Group (CSG) Segment

The CSG segment solutions include intelligent site management (ISM), cell site optimization (CSO), and outside plant (OSP) as follows:

• ISM solutions include a suite of Remote monitoring and control devices which, when combined with the Company's Optima management system, provides comprehensive machine-to-machine (M2M) communications that enable operators to remotely monitor, manage, and control site infrastructure and support systems.

• CSO solutions consist of tower mounted amplifiers (TMAs), small outdoor-hardened units mounted next to antennas on cell towers, enabling wireless service providers to improve the overall performance of a cell site, including increasing data throughput and reducing dropped connections.