August 11, 2016

Westell Technologies, Inc

750 North Common Drive

Aurora, Illinois 60504

To the Shareholders and Board of Directors of Westell:

Cove Street Capital, LLC is a Los Angeles based investment management firm with $1.1 billion in assets under management, an amount that sadly includes roughly 7.7 million shares of Westell Technologies, Inc (“Westell” or the “Company”) which represents 16.3% of the common stock class A shares outstanding.

Let’s get to it. The Board of Westell is, for all intents and purposes, held captive by a Family Trust led by one Robert “Buzz” C. Penny, III. Specifically, the trust owns 22% of the class A shares but more importantly owns the B-voting stock, providing it a 51% control interest in the Company.

The Company was founded in 1980 by Mr. Penny’s father, Clint Penny, and as far as we can tell, “Buzz” has never had anything to do with operating the Company; he has merely sat on the Board of Directors for almost 18 years as a controlling shareholder. During that period Buzz has presided over one of the worst shareholder records I have witnessed in my 32 years in the investment business. It is difficult to add anything to this table of woe:

| Two Decades of Total Returns as of August 8, 2016 | |||||

| 1-YR | 5-YR | 10-YR | 15-YR | 20-YR | |

| Westell | -40.9% | -73.4% | -70.8% | -52.4% | -98.0% |

| Russell 2000 | 0.6% | 76.8% | 81.2% | 157.6% | 276.6% |

| S&P 500 | 3.6% | 86.0% | 72.2% | 83.1% | 229.4% |

We are writing to call for an end to the charade before any more new growth ideas or second chance opportunities burn more cash and further destroy value. Just about any unbiased observer would conclude that the Company should immediately hire a credible, third-party investment banker and put the Company up for sale in order to salvage what lemonade can be salvaged. Our extensive research suggests there are legitimate, willing buyers who can provide scale to Westell’s minute product line.

While the Company’s management team is an honorable group and has been forthright regarding the difficulties of the industry, it has been proven by the experience of the last four CEOs that telecommunications equipment supply is at best a low margin, low return, miserable industry when you have some scale. What has become patently clear is that it is an exercise in futility to try and operate profitably at the size and scale of Westell. The announced restructuring plan is another exercise in futility

| 2101 E El Segundo Boulevard, Suite 302 | T | 424-221-5897 | www.CoveStreetCapital.com |

| El Segundo, California 90245 | F | 424-221-5888 | questions@CoveStreetCapital.com |

and there is no line of sight for the company to end a near Olympian record of burning cash for 19 out of the past twenty quarters. The Board of Directors of Westell, led by their controlling shareholder, have operated Westell as a near-hobby for almost two decades, burning cash through operations as well as poor acquisitions. Surely someone in the extended Penny family cares about his or her inheritance and wants to receive some kind of final cash dividend instead of a used DAS conditioner in the mail.

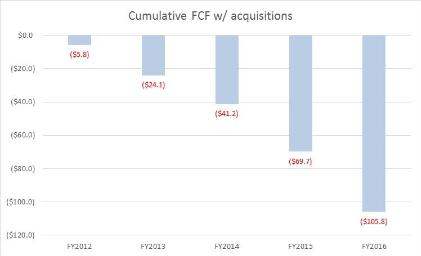

Another Sad Chart: Free Cash Flow (FCF) Down the Drain

As a point of reference, in 2012, Westell had $2.87 of cash per share, in addition to some remainder assets that could have been sold for cash. Instead, shareholders are looking at a current quote of 62 cents.

While we can go through several inches of paper that provides background on any number of these issues, I find it difficult to imagine there is a shareholder alive, including those with the Penny surname, who thinks that this is an acceptable state of affairs.

As the second largest shareholder in Westell, we have tried for several years to meet privately with Robert Penny, III, who controls the Trust which controls the majority of Westell’s shares—and have consistently received a complete Heisman from Mr. Penny, III. We were informed as recently as August 5th, 2016 (via voicemail from counsel no less) that once again he had no interest in meeting with Cove Street Capital principals in person or via telephone.

We are always a proponent of intelligent and private discourse with our partners in public company investing. Histrionics and debating strategic direction in a public forum is rarely a process that best delivers value in an acceptable manner. But every good idea has an inflection point where it stops being a good idea and we are at that juncture with Westell. Since Mr. Penny, III has definitively shut off options for intelligent and private discourse, we are going very public in an attempt to frankly shame what is at best

| 2101 E El Segundo Boulevard, Suite 302 | T | 424-221-5897 | www.CoveStreetCapital.com |

| El Segundo, California 90245 | F | 424-221-5888 | questions@CoveStreetCapital.com |

disinterested corporate governance. Unfortunately, at this point we have zero confidence in their collective incentives and motivation to do the right thing for shareholders, given their disastrous record of destroying their own wealth. Like a California voter who is not a registered Democrat, our vote may not mean much, but we have the motivation and tools to be active...and loud.

We would be remiss if we did not add the following very timely issue. The Company has been notified by NASDAQ that it is in violation of its $1 rule and our reading of NASDAQ regulations suggests the Company has until year-end to be above $1 or it will be delisted. May I have a show of hands of who wants to own Westell, controlled by the Penny family and its track record, as basically a private company? (Come to think of it, maybe that is EXACTLY what the controlling members of the Trust are trying to achieve.)

In closing, we urge the Penny Trust and its advisors to do what is obvious and coincidentally in their best interest. Since the latter is apparently all that has ever mattered to them, the choice to sell the Company should be an easy one.

Sincerely,

Jeffrey Bronchick, CFA

Principal, Portfolio Manager

JB:

| 2101 E El Segundo Boulevard, Suite 302 | T | 424-221-5897 | www.CoveStreetCapital.com | |

| El Segundo, California 90245 | F | 424-221-5888 | questions@CoveStreetCapital.com | |